10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 28, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36869

PJT Partners Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

36-4797143 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

280 Park Avenue New York, New York |

10017 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 364-7800

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

Class A common stock, par value $0.01 |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☒ NO ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10‑K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of June 30, 2018, the aggregate market value of the Registrant’s Class A common stock (based upon the closing stock price) held by non-affiliates was approximately $1.1 billion.

As of February 21, 2019, there were 22,769,626 shares of Class A common stock, par value $0.01 per share, and 202 shares of Class B common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement relating to its 2019 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

|

|

|

|

|

Page |

|

|

|

|

|

|

|

PART I. |

|

|

|

|

|

|

|

|

|

|

|

ITEM 1. |

|

|

3 |

|

|

|

|

|

|

|

|

ITEM 1A. |

|

|

8 |

|

|

|

|

|

|

|

|

ITEM 1B. |

|

|

24 |

|

|

|

|

|

|

|

|

ITEM 2. |

|

|

24 |

|

|

|

|

|

|

|

|

ITEM 3. |

|

|

25 |

|

|

|

|

|

|

|

|

ITEM 4. |

|

|

25 |

|

|

|

|

|

|

|

|

PART II. |

|

|

|

|

|

|

|

|

|

|

|

ITEM 5. |

|

|

26 |

|

|

|

|

|

|

|

|

ITEM 6. |

|

|

29 |

|

|

|

|

|

|

|

|

ITEM 7. |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

32 |

|

|

|

|

|

|

|

ITEM 7A. |

|

|

45 |

|

|

|

|

|

|

|

|

ITEM 8. |

|

|

46 |

|

|

|

|

|

|

|

|

ITEM 9. |

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

89 |

|

|

|

|

|

|

|

ITEM 9A. |

|

|

89 |

|

|

|

|

|

|

|

|

ITEM 9B. |

|

|

91 |

|

|

|

|

|

|

|

|

PART III. |

|

|

|

|

|

|

|

|

|

|

|

ITEM 10. |

|

|

92 |

|

|

|

|

|

|

|

|

ITEM 11. |

|

|

92 |

|

|

|

|

|

|

|

|

ITEM 12. |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

92 |

|

|

|

|

|

|

|

ITEM 13. |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

|

92 |

|

|

|

|

|

|

|

ITEM 14. |

|

|

92 |

|

|

|

|

|

|

|

|

PART IV. |

|

|

|

|

|

|

|

|

|

|

|

ITEM 15. |

|

|

93 |

|

|

|

|

|

|

|

|

ITEM 16. |

|

|

96 |

|

|

|

|

|

|

|

|

|

97 |

|||

1

PJT Partners Inc. was formed in connection with certain merger and spin-off transactions whereby the financial and strategic advisory services, restructuring and reorganization advisory services and Park Hill Group businesses of The Blackstone Group L.P. (“Blackstone” or our “former Parent”) were combined with PJT Capital LP, a financial advisory firm founded by Paul J. Taubman in 2013 (together with its then affiliates, “PJT Capital”), and the combined business was distributed to Blackstone’s unitholders to create PJT Partners Inc., a stand-alone, independent publicly traded company. Throughout this Annual Report on Form 10-K, we refer to this transaction as the “spin-off.” PJT Partners Inc. is a holding company and its only material asset is its controlling equity interest in PJT Partners Holdings LP, a holding partnership that holds the company’s operating subsidiaries, and certain cash and cash equivalents it may hold from time to time as described herein in “Part II. Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities—Dividend Policy.” As the sole general partner of PJT Partners Holdings LP, PJT Partners Inc. operates and controls all of the business and affairs of PJT Partners Holdings LP and its operating subsidiaries.

In this Annual Report on Form 10-K, unless the context requires otherwise, the words “PJT Partners Inc.” refers to PJT Partners Inc., and “PJT Partners,” the “Company,” “we,” “us” and “our” refer to PJT Partners Inc., together with its consolidated subsidiaries, including PJT Partners Holdings LP and its operating subsidiaries.

Forward-Looking Statements

Certain material presented herein contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include certain information concerning future results of operations, business strategies, acquisitions, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “might,” “should,” “could” or the negative of these terms or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in such forward-looking statements. You should not put undue reliance on any forward-looking statements contained herein. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

The risk factors discussed in the “Risk Factors” section of this report, as such factors may be updated from time to time in our periodic filings with the United States Securities and Exchange Commission (“SEC”), accessible on the SEC’s website at www.sec.gov, could cause our results to differ materially from those expressed in forward-looking statements. There may be other risks and uncertainties that we are unable to predict at this time or that are not currently expected to have a material adverse effect on our business. Any such risks could cause our results to differ materially from those expressed in forward-looking statements.

Website Disclosure

We use our website (www.pjtpartners.com) as a channel of distribution of company information. The information we post may be deemed material. Accordingly, investors should monitor the website, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may automatically receive e-mail alerts and other information about PJT Partners when you enroll your e-mail address by visiting the “Investor Relations” page of our website at ir.pjtpartners.com/investor-relations. Although we refer to our website in this report, the contents of our website are not included or incorporated by reference into this report. All references to our website in this report are intended to be inactive textual references only.

2

Overview

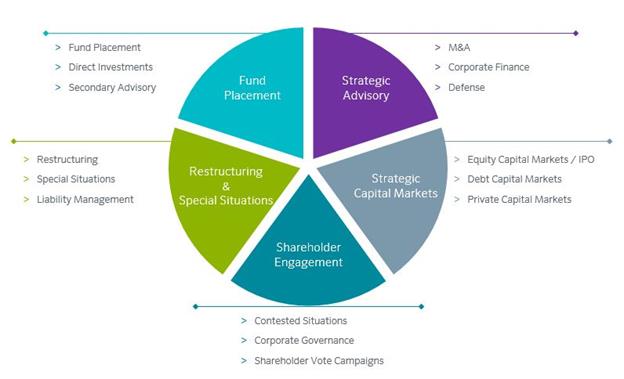

PJT Partners is a global advisory-focused investment bank. Our team of senior professionals delivers a wide array of strategic advisory, shareholder engagement, restructuring and special situations and private fund advisory and placement services to corporations, financial sponsors, institutional investors and governments around the world. We offer a unique portfolio of advisory services designed to help our clients achieve their strategic objectives. We also provide, through Park Hill, private fund advisory and placement services for alternative investment managers, including private equity funds, real estate funds and hedge funds. PJT Partners began trading on the New York Stock Exchange (“NYSE”) under the symbol “PJT” on October 1, 2015.

We have world-class franchises in each of the areas in which we compete:

Strategic Advisory

Our team of leading professionals delivers innovative solutions to highly complex challenges across mergers and acquisitions (“M&A”), strategic advisory and capital markets advisory. Our strategic advisory business offers a broad range of financial advisory and transaction execution capability, including M&A, joint ventures, minority investments, asset swaps, divestitures, takeover defenses, corporate finance advisory, private placements and distressed sales. In October 2018, we acquired CamberView Partners Holdings, LLC (“CamberView” or “PJT Camberview”), a leading provider of shareholder engagement services. PJT Camberview brings together the world’s leading experts from the investor community to help public companies understand, engage and succeed with their investors in complex and contested shareholder matters by developing insightful strategies, effective tactics and high impact messaging.

Restructuring and Special Situations

Our restructuring and special situations business is one of the world’s leading advisors in restructurings and recapitalizations, both in and out of court, around the globe. With vast expertise in highly complex capital structure challenges, our Restructuring and Special Situations Group’s services include advising companies, creditors and financial sponsors on recapitalizations, reorganizations, exchange offers, debt repurchases, capital raises and distressed mergers and acquisitions.

3

Park Hill, our private fund advisory and placement business, is a world-leading fund placement agent and provides private fund advisory and placement services for a diverse range of investment strategies. Moreover, Park Hill is the only group among its peers with top-tier dedicated private equity, hedge fund, real estate and secondary advisory groups.

Our Key Competitive Strengths

We intend to execute on our strategy by capitalizing on the following strengths of our organization:

|

|

• |

Strong Legacy, New Energy. PJT Partners combines three decades of experience and excellence with the energy and enthusiasm of a new firm. Our teams act as trusted advisors to a diverse group of clients around the world, providing clients with creative solutions addressing a range of complex strategic initiatives. The creativity and depth of our advice, and the integrity and judgment with which we deliver it, provide a strong foundation for our new and growing business. The quality of our advice is core to what we do. |

|

|

• |

One Dedicated Firm with Highly Complementary Businesses. Our firm benefits from having a number of leading and complementary businesses. Our differentiated and diverse portfolio of industry, product and geographical expertise enables us to serve our clients in a unique way. Our premier advisory practices allow us to provide best-in-class advice to clients whether they are looking for growth through strategic alternatives, advice in a restructuring or reorganization or access to capital. Our deep networks across businesses allow us to connect clients and help them meet their strategic objectives. |

|

|

• |

Defined by Deep Relationships. Our partners have decades of experience and long-standing relationships with a vast network of corporate executives, board members, financial sponsors, fund managers and governments. Their expertise across multiple product areas, industry verticals and geographies are sought by clients in complex, cross-border situations in dozens of countries. Our Park Hill business has generated long-standing relationships across Europe, the Middle East, Africa and Asia that give them unique access to global capital and drives incremental value for our clients. |

|

|

• |

Global Market Leadership. Our Restructuring and Special Situations Group is a global market leader. Our Park Hill business has a leading market position across all four of its businesses: private equity, hedge funds, real estate and secondary advisory. Our rapidly growing premier Strategic Advisory business is comprised of industry leading practitioners and has been the named advisor on some of the most high-profile and complex transactions. With the acquisition of CamberView, we added another best-in-class advisory business to our offering. |

|

|

• |

Strong Character, Culture and Collaboration. We have a cohesive partnership centered around core values, including character, culture and collaboration. Our culture provides the ideal environment for idea sharing, collaboration and innovation. Our bankers are encouraged to make frequent client connections and leverage the experience and insights of fellow partners to deliver clients optimal service and outcomes. Our culture also fosters retention of top talent and provides a superior platform from which to recruit top bankers at all levels. |

|

|

• |

Clients’ Results Are Our Reputation. Our success is built around the trust our clients have placed in us. We work every day to ensure that we are providing cutting edge advice on the critical matters facing our clients. We work to navigate our clients through complex challenges and bold opportunities to meet their strategic objectives. Delivering optimal outcomes is what we strive for – our clients’ results are our reputation. |

Our Growth Strategy

Our strategy to achieve our growth objectives has the following components:

|

|

• |

Maintain Market Leadership in Restructuring and Special Situations and Park Hill. Our firm is strengthened by the deep client relationships and strong brand reputations we have in our leading restructuring and special situations and Park Hill businesses. These businesses are benefiting from the new, independent platform through expanded financial sponsor dialogues; the elimination of certain conflicts associated with our former Parent; and increased footprint and product expertise in our growing strategic advisory business. |

4

|

|

• |

Expand Our Addressable Market. We are focused on expanding into new geographies, sectors and capabilities. |

|

|

• |

Significantly Increase the Breadth and Depth of Our Advisory Franchise. We are focused on expanding our capabilities in areas where a sizable market opportunity clearly exists by hiring expert, top-tier talent to expand into new industry verticals, geographies and product capabilities, which will enable us to offer increasingly comprehensive and valuable solutions to a broader base of clients. |

|

|

• |

Enhance Collaboration Among Our Businesses to Better Serve Clients. We operate a scaled, diversified global advisory franchise comprised of complementary businesses, which each share our culture of excellence, teamwork and entrepreneurship. Our partners and team members have relationships with a vast network of corporate executives, board members, financial sponsors, fund managers and governments as well as expertise in multiple product areas, industry verticals and geographies. By operating in a more integrated and cohesive manner we are able to offer our clients a comprehensive and differentiated suite of advisory services. In addition, our deep networks across our businesses allow us to connect clients and provide incremental value in helping them meet their strategic objectives. |

|

|

• |

Remain the Premier Destination for Talent. We will continue to attract best-in-class bankers who want to deliver a broad range of world-class services to their clients around the globe. We offer a unique and compelling proposition to them through our total focus on advisory services; commitment to building a culture of collaboration, character and growth; strong client relationships; deep and exceptional base of talent; and efficient and scalable support infrastructure. |

Our Talent

As a global advisory-focused investment bank focused solely on providing innovative services to our clients, our people are our most valuable asset. Our partners average over 25 years of relevant experience, which they leverage to provide the highest quality advice across our broad suite of strategic advisory, shareholder engagement, restructuring and special situations and private fund advisory and placement services. Our partners are supported by a first-rate team of professionals and we are committed to developing and maximizing their talent and skills. We strive to maintain a work environment that fosters professionalism, excellence, integrity and collaboration among our employees.

We opportunistically and strategically hire professionals with experience and backgrounds relevant to our various businesses. We work with prestigious undergraduate and graduate programs that have resulted in a steady and high-quality pipeline of junior financial professionals. We place a high degree of emphasis on cultural fit and individual character. Across our firm we devote significant time and resources to training and mentoring our employees to ensure every individual achieves their highest possible potential. This philosophy of investing in our people has been and will continue to be core to our culture and organization.

As of December 31, 2018, we employed 590 individuals globally, including 71 partners.

Competition

The financial services industry is intensely competitive, and we expect it to remain so. Our competitors are other investment banking and financial advisory firms. These entities include brokers and dealers, investment banking firms and commercial banks. We compete on both a global and a regional basis, and on the basis of a number of factors, including depth of client relationships, industry knowledge, transaction execution skills, our range of products and services, innovation, reputation and price.

We also compete to attract and retain qualified employees. Our ability to continue to compete effectively in our business will depend upon our ability to attract new employees and retain and motivate our existing employees.

Regulation

Our business, as well as the financial services industry generally, is subject to extensive regulation in the U.S. and across the globe. As a matter of public policy, regulatory bodies in the U.S. and the rest of the world are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets. In the U.S., the SEC is the federal agency responsible for the administration of the federal securities laws. PJT Partners LP, through which strategic advisory, shareholder

5

engagement and restructuring and special situations services are conducted in the United States, and Park Hill Group LLC, which is an entity within the Park Hill private fund advisory and placement services business, are registered broker-dealers. These registered broker-dealers are subject to regulation and oversight by the SEC. In addition, the Financial Industry Regulatory Authority (“FINRA”), a self-regulatory organization that is subject to oversight by the SEC, adopts and enforces rules governing the conduct, and examines the activities of, its member firms, which would include any such registered broker-dealer. State securities regulators also have regulatory or oversight authority over any such registered broker-dealer.

Broker-dealers are subject to regulations that cover all aspects of the securities business, including capital structure, recordkeeping and the conduct and qualifications of directors, officers and employees. In particular, as a registered broker-dealer and member of a self-regulatory organization, we are subject to the SEC’s uniform net capital rule, Rule 15c3-1. Rule 15c3-1 specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of a broker-dealer’s assets be kept in relatively liquid form. The SEC and various self-regulatory organizations impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC’s uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital.

PJT Partners LP is registered as a “municipal advisor” with the SEC and the Municipal Securities Rulemaking Board (the “MSRB”). In 2013 as required under the Dodd-Frank Act, the SEC issued its final rule regarding the new category of regulated financial activity: “municipal advisors” (the “MA Rule”). The MA Rule, which became effective in 2014, imposes a fiduciary duty on municipal advisors when advising municipal entities. In addition to the SEC rule, the MSRB has developed a number of implementing rules and interpretive guidance relating to municipal advisors, and we have implemented policies and procedures reasonably designed to comply with such rules and guidance. In recent years, broker-dealer and municipal advisor interaction with municipal entities has become an area of greater rulemaking and regulatory interest; however, we do not expect a materially adverse impact on municipal advisory services.

Further, Park Hill Group LLC is a registered commodity trading advisor with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”), a futures industry self-regulatory organization. The CFTC and NFA regulate futures contracts, swaps and various other financial instruments in which certain of Park Hill Group LLC’s clients may invest.

In addition to the regulation we are subject to in the U.S., we are subject to regulation internationally. PJT Partners (UK) Limited is licensed with the United Kingdom’s Financial Conduct Authority and is required to maintain regulatory net capital of €50 thousand. PJT Partners (HK) Limited is licensed with the Hong Kong Securities and Futures Commission and is subject to a minimum liquid capital requirement of HK$3 million.

Certain parts of our business are subject to compliance with laws and regulations of U.S. federal and state governments, non-U.S. governments, their respective agencies and/or various self-regulatory organizations or exchanges relating to, among other things, the privacy of client information. Any failure to comply with these regulations could expose us to liability and/or reputational damage.

The U.S. and non-U.S. government agencies and self-regulatory organizations, as well as state securities commissions in the U.S., are empowered to conduct periodic examinations and initiate administrative proceedings that can result in censure, fines, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer or its directors, officers or employees.

Broker-dealers are also subject to regulations, including the USA PATRIOT Act of 2001, which impose obligations regarding the prevention and detection of money-laundering activities, including the establishment of customer due diligence and other compliance policies and procedures.

Failure to comply with these requirements may result in monetary, regulatory and, in certain cases, criminal penalties. In connection with its administration and enforcement of economic and trade sanctions based on U.S. foreign policy and national security goals, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), publishes a list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted countries. It also lists individuals, groups and entities, such as terrorists and narcotics traffickers, designated under programs that are not country-specific. Collectively, such individuals and companies are called “Specially Designated Nationals,” or SDNs. Assets of SDNs are blocked, and we are generally prohibited from dealing with them. In addition, OFAC administers a number of comprehensive sanctions and embargoes that target certain countries, governments and geographic regions. We are generally prohibited from engaging in transactions involving any country, region or government that is subject to such comprehensive sanctions.

6

The Foreign Corrupt Practices Act (the “FCPA”) and the UK 2010 Bribery Act (the “UK Bribery Act”) prohibit the payment of bribes to foreign government officials and political figures. The FCPA prohibits us from making or offering to make any payment, or giving anything of value to a foreign official for the purpose of influencing that official to assist us in obtaining or retaining an improper business advantage. The FCPA has a broad reach, covering all U.S. companies and citizens doing business abroad, among others, and defining a foreign official to include not only those holding public office but also local citizens acting in an official capacity for or on behalf of foreign government-run or -owned organizations or public international organizations. The FCPA also requires maintenance of appropriate books and records and maintenance of adequate internal controls to prevent and detect possible FCPA violations. Similarly, the UK Bribery Act prohibits us from bribing, being bribed or making other prohibited payments to government officials or other persons to obtain or retain business or gain some other business advantage.

Park Hill Group LLC is also affected by various state and local regulations or policies that restrict or prohibit the use of placement agents in connection with investments by public pension funds, including but not limited to, regulations in New York State, New York City, Illinois and California. Similar measures are being considered or have been implemented in other jurisdictions.

Organizational Structure

PJT Partners Inc. is a holding company and its only material asset is its controlling equity interest in PJT Partners Holdings LP, and certain cash and cash equivalents it may hold from time to time as described herein in “Part II. Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities—Dividend Policy.” As the sole general partner of PJT Partners Holdings LP, PJT Partners Inc. operates and controls all of the business and affairs and consolidates the financial results of PJT Partners Holdings LP and its operating subsidiaries. The ownership interests of the holders (other than PJT Partners Inc.) of common units of partnership interest in PJT Partners Holdings LP (“Partnership Units”) are reflected as non-controlling interests in PJT Partners Inc.’s consolidated financial statements as of December 31, 2018.

Our employees and certain current and former Blackstone executive officers and employees also hold all issued and outstanding shares of the Class B common stock of PJT Partners Inc. The shares of Class B common stock have no economic rights but entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes that is equal to the aggregate number of vested and unvested Partnership Units and LTIP Units (which is a class of partnership interests) in PJT Partners Holdings LP held by such holder on all matters presented to stockholders of PJT Partners Inc. other than director elections and removals. In connection with the spin-off, Blackstone’s senior management, including Mr. Schwarzman and all of Blackstone’s other executive officers, provided an irrevocable proxy to Mr. Taubman to vote their shares of Class B common stock for so long as Mr. Taubman is the Chief Executive Officer of PJT Partners Inc. With respect to the election and removal of directors of PJT Partners Inc., shares of Class B common stock initially entitle holders to only one vote per share, representing significantly less than one percent of the voting power entitled to vote thereon. However, the voting power of Class B common stock with respect to the election and removal of directors of PJT Partners Inc. may be increased to up to the number of votes to which a holder is then entitled on all other matters presented to stockholders. The voting power on applicable matters afforded to holders of partnership interests by their shares of Class B common stock is automatically and correspondingly reduced as they exchange Partnership Units for cash or for shares of Class A common stock of PJT Partners Inc. pursuant to the exchange agreement. If at any time the ratio at which Partnership Units are exchangeable for shares of Class A common stock of PJT Partners Inc. changes from one-for-one, the number of votes to which Class B common stockholders are entitled on applicable matters will be adjusted accordingly. Holders of shares of our Class B common stock will vote together with holders of our Class A common stock as a single class on all matters on which stockholders are entitled to vote generally, except as otherwise required by law.

7

We and the holders of Partnership Units (other than PJT Partners Inc.) also have entered into an exchange agreement under which they (or certain permitted transferees) have the right, subject to the terms and conditions set forth in the partnership agreement of PJT Partners Holdings LP, on a quarterly basis, to exchange all or part of their Partnership Units for cash or, at our election, for shares of our Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for splits, unit distributions and reclassifications. Further, pursuant to the terms in the partnership agreement of PJT Partners Holdings LP, we may also require holders of Partnership Units who are not Service Providers (as defined in the partnership agreement of PJT Partners Holdings LP) to exchange such Partnership Units. The price per Partnership Unit to be received in a cash-settled exchange will be equal to the fair value of a share of our Class A common stock (determined in accordance with and subject to adjustment under the exchange agreement). In the event that PJT Partners Inc. elects to fund cash-settled exchanges of Partnership Units with new issuances of Class A common stock, the fair value of a share of our Class A common stock will be deemed to be equal to the net proceeds per share of Class A common stock received by PJT Partners Inc. in the related issuance. Accordingly, in this event, the price per Partnership Unit to which an exchanging Partnership Unitholder will be entitled may be greater than or less than the then-current market value of our Class A common stock.

Refer to Note 13. “Transactions with Related Parties” and Note 14. “Commitments and Contingencies—Transactions and Agreements with Blackstone” in the “Notes to Consolidated Financial Statements” in “Part II. Item 8. Financial Statements and Supplementary Data” for further information about agreements entered into in connection with the spin-off.

Available Information

We file annual, quarterly and current reports and other information with the SEC. These filings are available to the public over the internet at the SEC’s website at www.sec.gov.

Our website address is www.pjtpartners.com. We make available free of charge on or through www.pjtpartners.com our annual reports on Form 10‑K, quarterly reports on Form 10-Q, current reports on Form 8‑K, and amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Hard copies may be obtained free of charge by contacting Investor Relations at PJT Partners Inc., 280 Park Avenue, New York, New York 10017 or by calling (212) 364-7800. Although we refer to our website in this report, the contents of our website are not included or incorporated by reference into this report. All references to our website in this report are intended to be inactive textual references only.

Risks Relating to Our Business

Our future growth will depend on, among other things, our ability to successfully identify, recruit and develop talent and will require us to commit additional resources.

Our future growth will depend on, among other things, our ability to successfully identify and recruit individuals and teams to join our firm. It typically takes time for these professionals to become profitable and effective. During that time, we may incur significant expenses and expend significant time and resources toward training, integration and business development aimed at developing this new talent. If we are unable to recruit and develop profitable professionals, we will not be able to implement our growth strategy and our financial results could be materially adversely affected.

In addition, sustaining growth will require us to commit additional management, operational and financial resources and to maintain appropriate operational and financial systems to adequately support expansion, especially in instances where we open new offices that may require additional resources. There can be no assurance that we will be able to manage our expanding operations effectively, and any failure to do so could materially adversely affect our ability to grow revenue and control our expenses.

8

Changing market conditions, including as a result of tariffs and global trade uncertainties, can adversely affect our business in many ways, including by reducing the volume of the transactions involving our business, which could materially reduce our revenue.

As a participant in the financial services industry, we are materially affected by conditions in the global financial markets and economic conditions throughout the world, including many factors beyond our control, such as tariffs and global trade uncertainties. For example, a substantial portion of our revenue is directly related to the volume and value of the transactions in which we are involved. During periods of unfavorable market or economic conditions, the volume and value of M&A transactions may decrease, thereby reducing the demand for our M&A advisory services and increasing price competition among financial services companies seeking such engagements. In addition, during periods of strong market and economic conditions, the volume and value of restructuring and reorganization transactions may decrease, thereby reducing the demand for our restructuring and special situations services and increasing price competition among financial services companies seeking such engagements. Our results of operations would be adversely affected by any such reduction in the volume or value of such advisory transactions. Further, in the period following an economic downturn, the volume and value of M&A transactions typically takes time to recover and lags a recovery in market and economic conditions.

Our profitability may also be adversely affected by our fixed costs and the possibility that we would be unable to scale back other costs within a time frame sufficient to match any decreases in revenue relating to changes in market and economic conditions.

Our private fund advisory and placement services business is dependent on the availability of private capital for deployment in illiquid asset classes such as private equity, hedge and real estate funds for clients we serve.

Park Hill provides private fund advisory and placement services for alternative investment managers, including private equity funds, real estate funds and hedge funds. Our ability to find suitable engagements and earn fees in this business depends on the availability of private and public capital for investments in illiquid assets such as private equity, hedge and real estate funds. Our ability to assist fund managers and sponsors raise capital from investors depends on a number of factors, including many that are outside our control, such as the general economic environment, changes in the weight investors give to alternative asset investments as part of their overall investment portfolio among asset classes, and market liquidity and volatility. Additionally, certain investors, such as public pension plans, may have policies prohibiting the use of placement agents by fund sponsors or managers in connection with a limited partner’s investment. To the extent private and public capital focused on illiquid investment opportunities for our clients is limited, the results of Park Hill may be adversely affected.

Our revenue in any given period is dependent in part on the number of fee-paying clients in such period, and a significant reduction in the number of fee-paying clients in any given period could reduce our revenue and adversely affect our operating results in such period.

A substantial portion of our revenue in any given period is dependent in part on the number of fee-paying clients in such period. We had 141 clients and 120 clients that generated fees equal to or greater than $1 million for the years ended December 31, 2018 and 2017, respectively. We may lose clients as a result of the sale or merger of a client, a change in a client’s senior management, competition from other financial advisors and financial institutions and other causes. A significant reduction in the number of fee-paying clients in any given period could reduce our revenue and adversely affect our operating results in such period.

The composition of the group comprising our largest clients varies significantly from year to year, and a relatively small number of clients may account for a significant portion of our consolidated revenues in any given period. As a result, our operating results, financial condition and liquidity may be significantly affected by the loss of a relatively small number of mandates or the failure of a relatively small number of assignments to be completed. However, no client accounted for more than 10% of our total revenues for the years ended December 31, 2018 or 2017.

9

We have recorded net losses in the past and we may experience net losses in the future.

We have recorded consolidated or combined net losses in two of the five years ended December 31, 2018. A primary component of these net losses in each period was significant non-cash charges, consisting primarily of transaction-related compensation charges associated with Blackstone’s initial public offering (“IPO”), our spin-off from Blackstone, acquisition of CamberView, and the amortization of intangible assets that were recorded in connection with Blackstone’s IPO, acquisition of PJT Capital LP and acquisition of CamberView. We expect such non-cash charges to continue to be significant for the next few years and, as a result, we may record net losses during such periods.

If the number of debt defaults, bankruptcies or other factors affecting demand for our restructuring and special situations services declines, our restructuring and special situations business could suffer.

We provide various financial restructuring and reorganization and related advice to companies in financial distress or to their creditors or other stakeholders. A number of factors affect demand for these advisory services, including general economic conditions, the availability and cost of debt and equity financing, governmental policy and changes to laws, rules and regulations, including those that protect creditors. In addition, providing restructuring and special situations advisory services entails the risk that the transaction will be unsuccessful, takes considerable time and can be subject to a bankruptcy court’s discretionary power to disallow or discount our fees. If the number of debt defaults, bankruptcies or other factors affecting demand for our restructuring and special situations advisory services declines, our restructuring and special situations business would be adversely affected.

We depend on the efforts and reputations of Mr. Taubman and other key personnel.

We depend on the efforts and reputations of Mr. Taubman and our other senior bankers. Our senior banking team’s reputations and relationships with clients and potential clients are critical elements in the success of our business. Mr. Taubman and our other senior executives and bankers are important to our success because they are instrumental in setting our strategic direction, operating our business, identifying, recruiting and training key personnel, maintaining relationships with our clients, and identifying business opportunities. The loss of one or more of these executives or other key individuals could impair our business and development until qualified replacements are found. We may not be able to replace these individuals quickly or with persons of equal experience and capabilities. Although we have employment agreements with certain of these individuals, we cannot prevent them from terminating their employment with us. In addition, our non-competition agreements with such individuals may not be enforced by the courts. The loss of the services of any of them, in particular Mr. Taubman, could have a material adverse effect on our business, including our ability to attract clients.

Our ability to retain and motivate our partners and other key personnel is critical to the success of our business.

Our future success and growth depends to a substantial degree on our ability to retain and motivate our partners and other key personnel. Our professionals possess substantial experience and expertise and have strong relationships with our clients. As a result, the loss of these professionals could jeopardize our relationships with clients and result in the loss of client engagements. We may not be successful in our efforts to retain and motivate the required personnel as the market for qualified advisory and funds advisory services professionals is extremely competitive.

The near-term vesting of equity awarded to key personnel may diminish our ability to retain and motivate our professionals. There is no guarantee that our non-competition and current compensation arrangements with our professionals, in which we mandatorily defer a substantial portion of their annual incentive bonus in the form of cash and equity awards with multi-year vesting periods, will provide sufficient protections or incentives to prevent our partners and other key personnel from resigning to join our competitors. The departure of a number of partners or groups of professionals could have a material adverse effect on our business and profitability.

10

Our revenue and profits are highly volatile on a quarterly basis and may cause the price of our Class A common stock to fluctuate and decline.

Our revenue and profits are highly volatile. We earn advisory fees, generally from a limited number of engagements that generate significant fees at key transaction milestones, such as closing, the timing of which is outside of our control. We expect that we will continue to rely on advisory fees for a substantial portion of our revenue for the foreseeable future. Accordingly, a decline in our advisory engagements or the market for advisory services would adversely affect our business. In addition, our financial results will likely fluctuate from quarter to quarter based on the timing of when fees are recognized, and high levels of revenue in one quarter will not necessarily be predictive of continued high levels of revenue in future periods. Because advisory revenue is volatile and represents a significant portion of our total revenue, we may experience greater variations in our revenue and profits than other larger, more diversified competitors in the financial services industry. Fluctuations in our quarterly financial results could, in turn, lead to large adverse movements in the price of our Class A common stock or increased volatility in our stock price generally.

Because in many cases we are not paid until the successful consummation of the underlying transaction, our revenue is highly dependent on market conditions and the decisions and actions of our clients, interested third parties and governmental authorities. For example, we may be engaged by a client in connection with a sale or divestiture, but the transaction may not occur or be consummated because, among other things, anticipated bidders may not materialize, no bidder is prepared to pay our client’s price or because our client’s business experiences unexpected operating or financial problems. We may be engaged by a client in connection with an acquisition, but the transaction may not occur or be consummated for a number of reasons, including because our client may not be the winning bidder, failure to agree upon final terms with the counterparty, failure to obtain necessary regulatory consents or board or stockholder approvals, failure to secure necessary financing, adverse market conditions or because the target’s business experiences unexpected operating or financial problems. In these circumstances, we often do not receive significant advisory fees, despite the fact that we have devoted considerable resources to these transactions.

In addition, with respect to Park Hill, our private fund advisory and placement services business, we face the risk that we may not be able to collect on all or a portion of the fees that we recognize. The placement fees earned by Park Hill are generally recognized by us for accounting purposes upon the successful subscription by an investor in a client’s fund and/or the closing of that fund. However, those fees are typically paid by a Park Hill client over a period of time with interest (for example, three to four years) following such successful subscription by an investor in a client’s fund and/or the closing of that fund. There is a risk that during that period of time, Park Hill may not be able to collect all or a portion of the fees Park Hill is due for the funds advisory services it has already provided to such client. For instance, a Park Hill client’s fund may be liquidated prior to the time that all or a portion of the fees due to Park Hill are due to be paid. Moreover, to the extent fewer assets are raised for funds or interest by investors in alternative asset funds declines, the placement fees earned by Park Hill would be adversely affected.

In addition, we face the risk that certain clients may not have the financial resources to pay our agreed-upon advisory fees. Certain clients may also be unwilling to pay our advisory fees in whole or in part, in which case we may have to incur significant costs to bring legal action to enforce our engagement agreements to obtain our advisory fees. We recorded an allowance for doubtful accounts at December 31, 2018 and 2017 of $0.7 million and $1.9 million, respectively.

Future joint ventures, strategic investments and acquisitions may result in additional risks and uncertainties in our business.

In addition to recruiting and internal expansion, we may grow our core business through joint ventures, strategic investments or acquisitions, such as the acquisition of CamberView. In the event we make strategic investments or acquisitions, we would face numerous risks and would be presented with financial, managerial and operational challenges, including the difficulty of integrating personnel, retaining clients of the acquired entity, financial, accounting, technology and other systems and management controls.

11

Our failure to deal appropriately with actual, potential or perceived conflicts of interest could damage our reputation and materially adversely affect our business.

We confront actual, potential or perceived conflicts of interest in our business. We have adopted various policies, controls and procedures to address or limit actual or perceived conflicts of interest. However, these policies, controls and procedures may not timely identify or appropriately manage such conflicts of interest as identifying and managing actual or perceived conflicts of interest is complex and difficult. It is possible that actual, potential or perceived conflicts could give rise to client dissatisfaction, litigation or regulatory enforcement actions. Our reputation could be damaged if we fail, or appear to fail, to deal appropriately with one or more potential or actual conflicts of interest. Regulatory scrutiny of, or litigation in connection with, conflicts of interest could have a material adverse effect on our reputation, which could materially adversely affect our business in a number of ways, including a reluctance of some potential clients and counterparties to do business with us.

Policies, controls and procedures that we may be required to implement to address additional regulatory requirements, including as a result of additional foreign jurisdictions in which we operate, or to mitigate actual or potential conflicts of interest, may result in increased costs, including for additional personnel and infrastructure and information technology improvements, as well as limit our activities and reduce the positive synergies that we seek to cultivate across our businesses.

Employee or contractor misconduct, which is difficult to detect and deter, could harm us by impairing our ability to attract and retain clients and by subjecting us to legal liability and reputational harm.

There is a risk that our employees or contractors could engage in misconduct that would adversely affect our business. For example, our business often requires that we deal with confidential matters of great significance to our clients. If our employees or contractors were to improperly use or disclose confidential information provided by our clients, we could be subject to regulatory sanctions and suffer serious harm to our reputation, financial position, current client relationships and ability to attract future clients. It is not always possible to deter such misconduct, and the precautions we take to detect and prevent misconduct may not be effective in all cases. If our employees or contractors engage in misconduct, our business could be materially adversely affected.

The U.S. Department of Justice and the SEC continue to devote significant resources to the enforcement of the FCPA. In addition, the United Kingdom and other jurisdictions have significantly expanded the reach of their anti-bribery laws. While we have developed and implemented policies and procedures designed to ensure strict compliance by us and our personnel with the FCPA, such policies and procedures may not be effective in all instances to prevent violations. Any determination that we have violated the FCPA or other applicable anti-corruption laws could subject us to, among other things, civil and criminal penalties, material fines, profit disgorgement, injunctions on future conduct, securities litigation and a general loss of investor confidence, any one of which could adversely affect our business prospects, financial position or the market value of our common shares.

We may face damage to our professional reputation or negative publicity if our services are not regarded as satisfactory or for other reasons.

As an advisory service firm, we depend to a large extent on our relationships with our clients and reputation for integrity and high-caliber professional services to attract and retain clients. As a result, if a client is not satisfied with our services or we experience negative publicity related to our business and our people, regardless of whether the allegations are valid, it may be more damaging in our business than in other businesses.

We face strong competition from other financial advisory firms, many of which have greater resources and broader product and services offerings than we do.

The financial services industry is intensely competitive, highly fragmented and subject to rapid change, and we expect it to remain so. Our competitors are other investment banking and financial advisory firms. We compete on both a global and a regional basis, and on the basis of a number of factors, including the strength and depth of client relationships, industry knowledge, transaction execution skills, our range of products and services, innovation, reputation and price. In addition, in our business there are usually no long-term contracted sources of revenue. Each revenue-generating engagement typically is separately solicited, awarded and negotiated.

We have experienced significant competition when obtaining advisory mandates, and we may experience pricing pressures in our business in the future as some of our competitors may seek to obtain increased market share by reducing fees.

12

Our primary competitors are large financial institutions, many of which have far greater financial and other resources and have the ability to offer a wider range of products and services. In addition, we may be at a competitive disadvantage with regard to certain of our competitors who are able to and often do, provide financing or market making services that are often a crucial component of the types of transactions on which we advise. In addition to our larger competitors, over the last several years the number of independent investment banks that offer independent advisory services has increased. As these independent firms or new entrants into the market seek to gain market share, we could experience pricing and competitive pressures, which would adversely affect our revenues and earnings.

In addition, Park Hill operates in a highly competitive environment and the barriers to entry into the private fund advisory and placement services business are low.

As a member of the financial services industry, we face substantial litigation risks.

Our role as advisor to our clients on important transactions involves complex analysis and the exercise of professional judgment, including rendering “fairness opinions” in connection with mergers and other transactions. Our activities may subject us to the risk of significant legal liabilities to our clients and affected third parties, including shareholders of our clients who could bring securities class actions against us. In recent years, the volume of claims and amount of damages claimed in litigation and regulatory proceedings against financial services companies have increased. These risks are difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. Our engagements typically, but not always, include broad indemnities from our clients and provisions to limit our exposure to legal claims relating to our services, but these provisions may not protect us in all cases, including when a client does not have the financial capacity to pay under the indemnity. As a result, we may incur significant legal expenses in defending against or settling litigation. In addition, we may have to spend a significant amount to adequately insure against these potential claims. Substantial legal liability or significant regulatory action against us could have material adverse financial effects or cause significant reputational harm to us, which could seriously harm our business prospects.

Extensive and evolving regulation of our business and the business of our clients exposes us to the potential for significant penalties and fines due to compliance failures, increases our costs and may result in limitations on the manner in which our business is conducted.

As a participant in the financial services industry, we are subject to extensive regulation in the U.S. and internationally. We are subject to regulation by governmental and self-regulatory organizations in the jurisdictions in which we operate. As a result of market volatility and disruption in recent years, the U.S. and other governments have taken unprecedented steps to try to stabilize the financial system, including providing assistance to financial institutions and taking certain regulatory actions. The long-term effects of these actions and of legislative and regulatory initiatives (including the Dodd-Frank Wall Street Reform and Consumer Protection Act) effected in connection with, and as a result of, such extraordinary disruption and volatility is uncertain, both as to the financial markets and participants in general, and as to us in particular.

We face the risk of significant intervention by regulatory authorities, including extended investigation and surveillance activity, adoption of costly or restrictive new regulations and judicial or administrative proceedings that may result in substantial penalties. Among other things, we could be fined or be prohibited from engaging in some of our business activities. In addition, the regulatory environment in which we operate is subject to modification and further regulation. Such changes may increase the expenses we incur without necessarily leading to commensurate increases in operating revenue and income. Certain laws and regulations within the U.S. and internationally include extraterritorial application that may lead to overlapping or conflicting legal and regulatory burdens with additional risks and implementation expenses. New laws or regulations applicable to us and our clients also may adversely affect our business, and our ability to function in this environment will depend on our ability to constantly monitor and react to these changes.

Our ability to conduct business and our operating results, including compliance costs, may be adversely affected as a result of any new requirements imposed by the SEC, FINRA or other U.S. or foreign governmental regulatory authorities or self-regulatory organizations that regulate financial services firms or supervise financial markets. We may be adversely affected by changes in the interpretation or enforcement of existing laws and rules by these governmental authorities and self-regulatory organizations. In addition, some of our clients or prospective clients may adopt policies that exceed regulatory requirements and impose additional restrictions affecting their dealings with us. Accordingly, we may incur significant costs to comply with U.S. and international regulation. In addition, new laws or regulations or changes in enforcement of existing laws or regulations applicable to our clients

13

may adversely affect our business. For example, changes in antitrust laws or the enforcement of antitrust laws could affect the level of M&A activity and changes in applicable regulations could restrict the activities of our clients and their need for the types of advisory services that we provide to them. Further, changes to existing tax laws and regulations in the U.S. and in other jurisdictions in which we and our clients operate may reduce the level of M&A activity, including cross-border M&A activity.

The trade agreements under which U.S. companies currently exchange products and services around the world are subject to change. It is not known what specific measures might be proposed or how they would be implemented and enforced. There can be no assurance that pending or future legislation or execution in the U.S. that could significantly increase costs with respect to our foreign operations and, consequently, adversely affect our business, financial condition or results of operations, will not be enacted.

In addition, several states and municipalities in the United States, including, but not limited to, California, Illinois, New York State and New York City have adopted “pay-to-play” and placement agent rules, which, in addition to imposing registration and reporting requirements, limit our ability to charge fees in connection with certain engagements of Park Hill Group LLC or restrict or prohibit the use of placement agents in connection with investments by public pension funds. These types of measures could materially and adversely impact our Park Hill business.

Our failure to comply with applicable laws or regulations could result in adverse publicity and reputational harm as well as fines, suspensions of personnel or other sanctions, including revocation of our registration or any of our subsidiaries as a financial advisor and could impair retention or recruitment of personnel. In addition, any changes in the regulatory framework could impose additional expenses or capital requirements on us, result in limitations on the manner in which our business is conducted, have an adverse impact upon our financial condition and business and require substantial attention by senior management. Moreover, our business is subject to periodic examination by various regulatory authorities, and we cannot predict the outcome of any such examinations.

Our business is subject to various cybersecurity and other operational risks.

We face various cybersecurity and other operational risks related to our business on a day-to-day basis. We rely heavily on financial, accounting, communication and other information technology systems, and the people who operate them. These systems, including the systems of third parties on whom we rely, may fail to operate properly or become disabled as a result of tampering or a breach of our network security systems or otherwise, including for reasons beyond our control.

Our clients typically provide us with sensitive and confidential information. We are dependent on information technology networks and systems to securely process, transmit and store such information and to communicate among our locations around the world and with our clients and other third parties. We may be subject to attempted security breaches and cyber-attacks and, while we are not aware of any such occurrence that may have had a material impact to date, a successful breach of our systems, or the systems used by our clients and other third parties, could lead to shutdowns or disruptions of our systems or third-party systems on which we rely and potential unauthorized disclosure of sensitive or confidential information. Breaches of our or third-party network security systems on which we rely could involve attacks that are intended to obtain unauthorized access to our proprietary information, destroy data or disable, degrade or sabotage our systems, often through the introduction of computer viruses, cyber-attacks and other means and could originate from a wide variety of sources, including unknown third parties outside the firm. Although we take various measures to ensure the integrity of our and third-party systems on which we rely, there can be no assurance that these measures will provide adequate protection, especially because the cyber-attack techniques used change frequently or are not recognized until launched. As cyber threats continue to multiply, become more sophisticated and threaten additional aspects of our businesses, we may also be required to expend additional resources on information security and compliance costs in order to continue to modify or enhance our protective measures or to investigate and remediate any information security vulnerabilities or other exposures. If our or third-party systems on which we rely are compromised, do not operate properly or are disabled, we could suffer a disruption of our business, financial losses, liability to clients, regulatory sanctions and damage to our reputation.

We operate a business that is highly dependent on information systems and technology. Any failure to keep accurate books and records can render us liable to disciplinary action by governmental and self-regulatory authorities, as well as to claims by our clients. We rely on third-party service providers for certain aspects of our business. Any interruption or deterioration in the performance of these third parties or failures of their information systems and technology could impair our operations, affect our reputation and adversely affect our business.

14

In addition, a disaster or other business continuity problem, such as a pandemic, other man-made or natural disaster or disruption involving electronic communications or other services used by us or third parties with whom we conduct business, could lead us to experience operational challenges, and our inability to timely and successfully recover could materially disrupt our business and cause material financial loss, regulatory actions, reputational harm or legal liability.

We may not be able to generate sufficient cash in the future to service any current or future indebtedness or other contractual obligations, or a significant deterioration in the credit markets or the failure of one or more commercial banking institutions, could adversely affect our liquidity.

Our ability to make scheduled payments on or to refinance any current or future debt obligations or other contractual obligations depends on our financial condition and operating performance. We cannot provide assurance that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal of, and interest on, any current or future indebtedness. If our cash flows and capital resources are insufficient to fund any current or future debt service obligations, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance such indebtedness or other contractual obligations.

As of December 31, 2018, we had cash, cash equivalents and investments of $108.3 million, of which $3.3 million was invested in U.S. Treasury securities. We monitor developments relating to the liquidity of these instruments on a regular basis. In the event of a significant deterioration of the credit markets or the failure of one or more commercial banking institutions, there can be no assurance that we will be able to liquidate these assets or access our cash. Our inability to access our cash or other assets could have a material adverse effect on our liquidity and result in our inability to meet our obligations timely, which could have a material adverse effect on the value of our stock.

Our international operations are subject to certain risks, which may affect our revenue.

For the year ended December 31, 2018, we earned 19.2% of our total revenues from our international operations. We intend to continue to grow our non-U.S. business, and this growth is important to our overall success. In addition, many of our clients are non-U.S. entities seeking to enter into transactions involving U.S. businesses. Our international operations carry special financial, business, regulatory and reputational risks, which could include the following:

|

|

• |

greater difficulties in managing and staffing foreign operations; |

|

|

• |

language and cultural differences; |

|

|

• |

fluctuations in foreign currency exchange rates that could adversely affect our results; |

|

|

• |

unexpected and costly changes in trading policies, regulatory requirements, tariffs and other barriers; |

|

|

• |

restrictions on travel; |

|

|

• |

longer transaction cycles; |

|

|

• |

higher operating costs; |

|

|

• |

local labor conditions and regulations; |

|

|

• |

adverse consequences or restrictions on the repatriation of earnings; |

|

|

• |

potentially adverse tax consequences, such as trapped foreign losses; |

|

|

• |

less stable political and economic environments; and |

|

|

• |

civil disturbances or other catastrophic events that reduce business activity. |

If our international business increases relative to our total business, these factors could have a more pronounced effect on our operating results.

15

As part of our day-to-day operations outside of the United States, we are required to create compensation programs, employment policies, compliance policies and procedures and other administrative programs that comply with the laws of multiple countries. We also must communicate and monitor standards and directives across our global operations. Our failure to successfully manage and grow our geographically diverse operations could impair our ability to react quickly to changing business and market conditions and to enforce compliance with non-U.S. standards and procedures.

We may enter into new lines of business, which may result in additional risks and uncertainties in our business.

We currently generate substantially all of our revenue from our strategic advisory, shareholder engagement, restructuring and special situations and private fund advisory and placement services businesses. However, we may grow our business by entering into new lines of business. To the extent we enter into new lines of business, we will face numerous risks and uncertainties, including risks associated with actual or perceived conflicts of interest because we would no longer be limited to the advisory business, the possibility that we have insufficient expertise to engage in such activities profitably or without incurring inappropriate amounts of risk, the required investment of capital and other resources and the loss of clients due to the perception that we are no longer focusing on our core business.

Entry into certain lines of business may subject us to new laws and regulations with which we are not familiar, or from which we are currently exempt, and may lead to increased litigation and regulatory risk. In addition, certain aspects of our cost structure, such as costs for compensation, occupancy and equipment rentals, communication and information technology services, and depreciation and amortization will be largely fixed, and we may not be able to timely adjust these costs to match fluctuations in revenue related to our entering into new lines of business. If a new business generates insufficient revenues or if we are unable to efficiently manage our expanded operations, our results of operations could be materially adversely affected.

Fluctuations in foreign currency exchange rates could adversely affect our results.

Because our financial statements are denominated in U.S. dollars and we receive a portion of our net revenue in other currencies, we are exposed to fluctuations in foreign currencies. In addition, we pay certain of our expenses in such currencies. We have not entered into any transactions to hedge our exposure to these foreign exchange fluctuations through the use of derivative instruments or otherwise. An appreciation or depreciation of any of these currencies relative to the U.S. dollar would result in an adverse or beneficial impact, respectively, to our financial results.

A change in relevant income tax laws, regulations or treaties or an adverse interpretation of these items by tax authorities could result in an audit adjustment or revaluation of our deferred tax assets that may cause our effective tax rate and tax liability to be higher than what is currently presented in the consolidated financial statements.

As part of the process of preparing our consolidated financial statements, we are required to estimate income taxes in each of the jurisdictions in which we operate. Significant management judgment is required in determining our provision for income taxes, our deferred tax assets and liabilities and any valuation allowance recorded against our deferred tax assets. This process requires us to estimate our actual current tax liability and to assess temporary differences resulting from differing book versus tax treatment. Our effective tax rate and tax liability is based on the application of current income tax laws, regulations and treaties. These laws, regulations and treaties are complex, and the manner in which they apply to our facts and circumstances is sometimes open to interpretation. Management believes its application of current laws, regulations and treaties to be correct and sustainable upon examination by the tax authorities. However, the tax authorities could challenge our interpretation resulting in additional tax liability or adjustment to our income tax provision that could increase our effective tax rate. In addition, tax laws, regulations or treaties enacted in the future may cause us to remeasure our deferred tax assets and have a material change to our effective tax rate.

The Tax Cuts and Jobs Act (the “Tax Legislation”) has significantly changed the U.S. federal income taxation of U.S. corporations, including by reducing the U.S. corporate income tax rate, limiting interest deductions, permitting immediate expensing of certain capital expenditures, adopting elements of a territorial tax system, imposing a one-time transition tax (or “repatriation tax”) on all undistributed earnings and profits of certain U.S.-owned foreign corporations, revising the rules governing net operating losses and the rules governing foreign tax credits and introducing new anti-base erosion provisions. Many of these changes were effective immediately, without any transition periods or grandfathering for existing transactions. Accounting principles generally accepted

16

in the United States of America required all companies to reflect the effects of the new law in financial statements of the period in which the law was enacted. Accordingly, we remeasured our deferred tax assets and liabilities based on the new rate and recorded an adjustment related to a decrease in the Amount Due Pursuant to Tax Receivable Agreement as of December 31, 2017. We urge our investors to consult with their legal and tax advisors with respect to such legislation and the potential tax consequences of investing in our Class A common stock.

The range of potential outcomes relating to arrangements between the European Union and the United Kingdom may adversely affect our business.