Exhibit 99.1

September , 2015

To the Unitholders of Blackstone:

I am pleased to inform you that the board of directors of our general partner has approved a plan to separate Blackstone’s financial and strategic advisory services, restructuring and reorganization advisory services and Park Hill Group businesses from Blackstone to form an independent, publicly traded company called PJT Partners. Following completion of the transaction, the new company will be a leading global independent financial advisory firm.

We are proud of Blackstone’s roots as an advisory firm dating back to its formation in 1985 and the integral role it has played in building our successful global business and brand. The decision to pursue a separation is not one that was entered into lightly, but we believe it represents a great opportunity to make a strong advisory business even stronger and further unlock its potential value to the benefit of our common unitholders.

The spin-off will free our advisory businesses from the current constraints on their expansion opportunities that have arisen from the growth and broadening of our asset management business. Our advisory professionals have been effectively precluded from competing for engagements in many transactions where the potential for an investment by a Blackstone fund created an actual or perceived conflict of interest.

In addition, Blackstone will be better positioned to devote its full efforts and resources toward the unrestricted growth of its core asset management businesses and better serving its fund investors, free from conflict management and other challenges caused by being a part of a combined enterprise with our advisory businesses.

Paul J. Taubman will serve as PJT Partners’ Chairman and Chief Executive Officer. Before departing to found PJT Capital LP (together with its general partner and their respective subsidiaries, “PJT Capital”), an independent financial advisory firm, Mr. Taubman spent 30 years at Morgan Stanley where he served as Co-President of the Institutional Securities Group. Prior to becoming Co-President, he was the Head of Global Investment Banking and Head of its Global Mergers and Acquisitions Department. In addition to being one of the preeminent investment bankers in the world, Mr. Taubman is a proven leader with the experience and skill to lead this business in its new life as an independent public company.

We believe combining the strong heritage and track record of Blackstone’s advisory businesses with Mr. Taubman’s team and vision of creating a next generation advisory platform, will lead to substantial growth and value creation of the combined business. Moreover, we believe that the opportunity to practice at a dedicated advisory firm whose core mission is providing client-focused advice and solutions is a compelling proposition for practitioners that increasingly seek to leave behind large financial institutions.

On the distribution date, we will distribute on a pro rata basis Class A common stock of PJT Partners Inc. to our common unitholders of record as of 5:00 PM, New York time, on September 22, 2015, the spin-off record date. Each common unitholder of Blackstone will receive one share of Class A common stock of PJT Partners Inc. for every 40 common units of Blackstone held by such unitholder on the record date. The distribution of these shares will be made in book-entry form, which means that no physical share certificates will be issued. Following the spin-off, shareholders may request that their shares of Class A common stock be transferred to a brokerage or other account at any time. Prior to consummating the spin-off, PJT Partners will acquire PJT Capital.

The consummation of the spin-off and related transactions, including the acquisition of PJT Capital, is subject to certain conditions, as described in the enclosed information statement. Approval by Blackstone’s common unitholders of the spin-off, including the acquisition of PJT Capital and the distribution, is not required, nor are you required to take any action to receive your shares of Class A common stock of PJT Partners Inc.

Immediately following the spin-off, you will own both common units of Blackstone and Class A common stock of PJT Partners Inc. The common units of Blackstone will continue to trade on the New York Stock Exchange under the symbol “BX.” PJT Partners Inc. intends to have its Class A common stock listed on the New York Stock Exchange under the symbol “PJT.”

We expect that the spin-off will be tax-free to Blackstone’s common unitholders for U.S. Federal income tax purposes, except to the extent of any gain or loss recognized by a common unitholder as a result of any cash received in lieu of fractional shares. The spin-off is conditioned on, among other things, Blackstone’s receipt of an opinion of tax counsel to the effect that certain transactions in the spin-off should qualify as tax-free distributions under Section 355 of the Internal Revenue Code of 1986, as amended (the “Code”), and that a certain transaction in the spin-off should qualify as a tax-free reorganization under Section 368 of the Code.

We have prepared an information statement, which describes the spin-off in great detail and contains important information about PJT Partners, including historical financial statements. We are mailing to all Blackstone common unitholders a notice with instructions informing holders how to access the information statement online. We urge you to read the information statement carefully.

I want to thank you for your continued support of Blackstone, and we all look forward to your support of both companies in the future.

Yours sincerely,

Stephen A. Schwarzman

Chairman & CEO

Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

SUBJECT TO COMPLETION, DATED SEPTEMBER 2, 2015

INFORMATION STATEMENT

PJT Partners Inc.

Class A Common Stock

(par value $0.01 per share)

This information statement is being sent to you in connection with the separation of PJT Partners Inc. and its consolidated subsidiaries from The Blackstone Group L.P. (together with its consolidated subsidiaries, “Blackstone”), following which PJT Partners Inc. will be an independent, publicly traded company.

The Blackstone Group L.P. will distribute on a pro rata basis to its common unitholders all of the issued and outstanding shares of Class A common stock of PJT Partners Inc. held by it. We refer to this pro rata distribution as the “distribution” and we refer to the separation of the PJT Partners business from Blackstone and related transactions, including the distribution, and the internal reorganization and acquisition by PJT Partners of PJT Capital LP (together with its general partner and their respective subsidiaries, “PJT Capital”) that will precede the distribution, as the “spin-off.” We expect that the spin-off will be tax-free to Blackstone’s common unitholders for U.S. Federal income tax purposes, except to the extent of any gain or loss recognized by a common unitholder as a result of any cash received in lieu of fractional shares. Each common unitholder of Blackstone will receive one share of Class A common stock of PJT Partners Inc. for every 40 common units of Blackstone held by such unitholder on September 22, 2015, the record date. Each share of Class A common stock of PJT Partners Inc. will have attached to it a preferred stock purchase right as further described in “Description of Our Capital Stock—Anti-Takeover Effects of Our Amended and Restated Certificate of Incorporation, Our Amended and Restated Bylaws, Our Stockholder Rights Agreement and Certain Provisions of Delaware Law.” The distribution of shares will be made in book-entry form. Blackstone will not distribute any fractional shares of Class A common stock of PJT Partners Inc. Instead, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate net cash proceeds from the sales pro rata to each holder who would otherwise have been entitled to receive a fractional share in the spin-off. The distribution will be effective as of 12:01 AM, New York time, on October 1, 2015. Immediately after the distribution becomes effective, we will be an independent, publicly traded company.

Upon completion of the spin-off, PJT Partners Inc. will be a holding company and its only material asset will be a controlling equity interest in PJT Partners Holdings LP, a holding partnership that will hold PJT Partners’ operating subsidiaries. The internal owners (as described herein) will hold Class A common stock of PJT Partners Inc. as well as common units of partnership interest in PJT Partners Holdings LP (“Partnership Units”) that, subject to certain terms and conditions, are exchangeable at the option of the holder for a cash amount equal to the then-current market value of an equal number of shares of our Class A common stock, or, at our election, for shares of our Class A common stock on a one-for-one basis. Each Partnership Unit will have attached to it a preferred unit purchase right as further described in “Certain Relationships and Related Party Transactions—PJT Partners Holdings LP Limited Partnership Agreement.” The internal owners will also hold shares of Class B common stock of PJT Partners Inc. The shares of Class B common stock will have no economic rights but will entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes that is equal to the aggregate number of vested and unvested Partnership Units and LTIP Units (as described herein) in PJT Partners Holdings LP held by such holder on all matters presented to stockholders of PJT Partners Inc. other than director elections and removals. With respect to the election and removal of directors of PJT Partners Inc., shares of Class B common stock will initially entitle holders to only one vote per share, representing significantly less than one percent of the voting power entitled to vote thereon. However, the voting power of Class B common stock with respect to the election and removal of directors of PJT Partners Inc. may be increased to up to the number of votes to which a holder is then entitled on all other matters presented to stockholders, as described under “Description of Capital Stock—Class B Common Stock.” In addition, in connection with the spin-off, PJT Partners personnel will receive various types of awards under our 2015 Omnibus Incentive Plan denominated in shares of Class A common stock of PJT Partners Inc. and partnership interests in PJT Partners Holdings LP. See “Certain Relationships and Related Party Transactions—Transaction Agreement” and “—Agreements with Blackstone Related to the Spin-Off—Employee Matters Agreement” for additional information.

No vote or other action of Blackstone common unitholders is required in connection with the spin-off. We are not asking you for a proxy and you should not send us a proxy. Blackstone common unitholders will not be required to pay any consideration for the shares of Class A common stock of PJT Partners Inc. they receive in the spin-off, and they will not be required to surrender or exchange their Blackstone common units or take any other action in connection with the spin-off.

There is no current trading market for Class A common stock of PJT Partners Inc. We expect, however, that a limited trading market for Class A common stock of PJT Partners Inc., commonly known as a “when-issued” trading market, will develop at least two trading days prior to the record date for the distribution, and we expect “regular-way” trading of Class A common stock of PJT Partners Inc. will begin the first trading day after the distribution date. We have been approved to list Class A common stock of PJT Partners Inc. on the New York Stock Exchange (“NYSE”) under the ticker symbol “PJT”.

We are an “emerging growth company” as defined under the Federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. See “Summary—Implications of Being an Emerging Growth Company.”

In reviewing this information statement, you should carefully consider the matters described in “Risk Factors” beginning on page 34 of this information statement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement is not an offer to sell, or a solicitation of an offer to buy, any securities.

The date of this information statement is September , 2015.

A Notice of Internet Availability of Information Statement Materials containing instructions describing how to access this Information Statement was first mailed to Blackstone common unitholders on or about , . For Blackstone common unitholders who previously elected to receive paper copies of Blackstone’s materials, this information statement was first mailed to Blackstone common unitholders on or about September , 2015.

| Page | ||||

| 1 | ||||

| 34 | ||||

| 54 | ||||

| 55 | ||||

| 70 | ||||

| 72 | ||||

| 73 | ||||

| 75 | ||||

| 76 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

87 | |||

| 104 | ||||

| 114 | ||||

| 127 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

145 | |||

| 148 | ||||

| 158 | ||||

| F-1 | ||||

i

This summary highlights information contained in this information statement and provides an overview of our company, our separation from Blackstone and the distribution of shares of Class A common stock of PJT Partners Inc. by The Blackstone Group L.P. to its common unitholders. For a more complete understanding of our business and the spin-off, you should read this entire information statement carefully, particularly the discussion set forth under “Risk Factors” and our audited historical financial statements, our unaudited pro forma combined financial statements and the respective notes to those statements included in this information statement.

Except as otherwise indicated or unless the context otherwise suggests, references in this information statement to “PJT Partners,” “the Company,” “our company,” “we,” “us” and “our” refer (1) prior to the consummation of the internal reorganization and the acquisition as described under “The Spin-Off—Manner of Effecting the Spin-Off,” to the financial and strategic advisory services, restructuring and reorganization advisory services and Park Hill Group businesses of Blackstone, which, together with the capital markets services business that will be retained by Blackstone, have historically constituted Blackstone’s Financial Advisory reporting segment and (2) after the consummation of such internal reorganization and acquisition, to PJT Partners Inc. and its consolidated subsidiaries, including the acquired operations of PJT Capital LP (together with its general partner and their respective subsidiaries, “PJT Capital”). Except as otherwise indicated or unless the context otherwise suggests, references in this information statement to “Blackstone” refer to The Blackstone Group L.P. and its consolidated subsidiaries. Except as otherwise indicated or unless the context otherwise suggests, we use the term “partner” in this information statement to refer to our senior professionals who hold the “partner” title.

Our Business

PJT Partners is a global independent financial advisory firm. Our veteran team of professionals, including our 31 partners, delivers a wide array of strategic advisory, restructuring and reorganization and funds advisory services to corporations, financial sponsors, institutional investors and governments around the world. We offer a balanced portfolio of advisory services designed to help our clients realize major corporate milestones. We also provide, through Park Hill Group, fund placement and secondary advisory services for alternative investment managers, including private equity funds, real estate funds and hedge funds.

We have world-class franchises in each of the areas in which we compete. Our strategic advisory business, established in 1985, offers a broad range of financial advisory and transaction execution capability, including acquisitions, mergers, joint ventures, minority investments, asset swaps, divestitures, takeover defenses, corporate finance advisory, private placements and distressed sales. Since inception, we have advised on more than 292 announced M&A transactions with a total value of more than $600 billion. The combined value of the announced M&A transactions that we and PJT Capital advised on over the past two years was more than $195 billion. Our restructuring and reorganization business, established in 1991, is one of the world’s leading restructuring advisors, having advised on more than 400 distressed situations, both in and out of bankruptcy, involving more than $1.5 trillion of total liabilities. Park Hill Group, our funds advisory services business, is the world’s leading private equity and real estate fund placement agent, having served as a placement agent to more than 194 funds raising approximately $261 billion for a diverse range of investment strategies since its inception in 2005. Moreover, Park Hill Group is the only group among its peers with top-tier dedicated private equity, hedge fund and real estate advisory groups, as well as a dedicated team that supports secondary transactions in limited partnership interests in existing funds.

We believe the success of our business has resulted from a highly-experienced team and a relentless focus on our core principles: prioritizing our client’s interests, providing superior client service, protecting client confidentiality and avoiding conflicts of interest. As of June 30, 2015, our strategic advisory team was comprised

1

of 100 professionals, including 9 partners, with an average of over 22 years of experience in providing corporate finance and mergers and acquisitions advice. As of June 30, 2015, our restructuring and reorganization team was comprised of 51 professionals, including 8 partners with an average of 18 years of experience advising a diverse base of clients, including companies, creditors, corporate parents, hedge funds, financial sponsors and acquirers of troubled companies. We believe that we have one of the most seasoned and experienced restructuring teams in the financial services industry, working on a significant share of the major restructuring assignments in this area. As of June 30, 2015, our Park Hill Group team was comprised of 84 professionals, including 14 partners with an average of over 20 years of experience advising and executing on all aspects of the fundraising process, and operates across seven offices around the world.

Our firm will be led by Paul J. Taubman, who will serve as our Chairman and Chief Executive Officer. Before departing in late 2012, Mr. Taubman spent 30 years at Morgan Stanley where he served as Co-President of the Institutional Securities Group. Prior to becoming Co-President, he served as Head of Global Investment Banking and Head of its Global Mergers and Acquisitions Department. In addition to being one of the preeminent investment bankers in the world, Mr. Taubman is a proven leader with the experience and skill to lead PJT Partners in its new life as an independent public company. Since departing Morgan Stanley, Mr. Taubman and PJT Capital have advised on transactions with a total value of more than $140 billion.

Mr. Taubman joins us with a team of veteran investment bankers, including 14 partners, who have a wealth of experience and client relationships developed over long tenures in the investment banking industry, and who share a common commitment to excellence. Through their sizable equity stake in our business, a significant portion of which is subject to performance-based vesting, the long-term incentives of Mr. Taubman and our partners will be strongly aligned with the interests of our stockholders. Upon completion of the spin-off, our partners, advisory professionals and other employees will initially own in the aggregate over 38.9% of the equity in our business, assuming the equity awards to be received by such persons in connection with the spin-off were fully vested and earned.

We believe this spin-off will further unlock our potential by meaningfully enhancing our opportunities for organic growth, including by enhancing our ability to compete for business from financial sponsors and eliminating conflicts with Blackstone’s investing areas.

| • | Conflicts with other financial sponsors. We believe the ability to compete unhindered by the inherent challenges of securing business from Blackstone competitors significantly increases the addressable market of our advisory and placement services. For instance, while transactions involving financial sponsors represented nearly a third of global M&A advisory volume by transaction value in 2014, such transactions represented only 10% of the advisory revenue generated by our strategic advisory and restructuring and reorganization businesses in the same period. |

| • | Conflicts with Blackstone’s investing areas. As part of Blackstone, we have been effectively precluded from competing for strategic advisory and restructuring engagements in many transactions where an investment or potential investment by a Blackstone fund created an actual or perceived conflict of interest. An advisory engagement can have the effect of precluding or limiting an investment opportunity of a Blackstone fund given that advisory clients may require Blackstone to act exclusively on behalf of a potential seller, buyer or other party in a subject transaction. As a result, we have declined to compete for many advisory assignments in order to avoid creating a potential conflict with a potential Blackstone investment opportunity. In that connection, sellers may resist engaging our strategic advisory team if they see a reasonable possibility that a Blackstone investing business could be a buyer. Investment conflicts have also been particularly prevalent as between our restructuring and reorganization practice and Blackstone’s credit business. |

2

We believe the impact of these actual or perceived conflicts has been to artificially constrain the growth opportunities that PJT Partners might otherwise have enjoyed as an independent company, including mandates we have lost to competitors and business that we declined to compete for in the first instance.

We additionally believe we will excel in attracting and retaining world-class professionals. We believe that the opportunity to practice at a dedicated advisory firm whose core mission is providing client-focused advice and solutions is a compelling proposition for practitioners that increasingly seek to leave behind large financial institutions. Moreover, while we and PJT Capital have enjoyed great success recruiting, we believe that the freedom from conflicts and increased addressable market that will result from the spin-off will make our firm even more attractive to new hires.

Since our founding, we have earned a reputation as a trusted, long-term strategic advisor by providing thoughtful, tailored solutions to help our clients achieve their strategic, financial and fundraising goals. Together, our objective is to become the leading provider of financial advice and the top destination for advisory talent.

Our revenues for the year ended December 31, 2014 were $401.1 million. As of June 30, 2015, we employed 235 professionals across 11 offices around the world.

Our Strategy

We intend to grow our business by increasing our share of business from existing clients and developing new client relationships as we expand into new industry verticals, geographies and products. Our strategy for achieving these objectives has five components:

| • | Provide World-Class Financial Advice. The creativity and depth of our advice, and the integrity and judgment with which we deliver it, are the foundations of the business we have built. As the newly independent PJT Partners, we intend to build on nearly three decades of commitment to excellence in the work we do and the delivery of superior outcomes for our clients across our full suite of advisory services. |

| • | Invest in New Capabilities to Better Serve Our Clients. We are focused on continuing to expand the breadth and depth of our platform and build capabilities in areas where a sizable market opportunity clearly exists in order both to expand wallet share with existing clients and to develop new client relationships. Such efforts may include expansion into new industry verticals, geographies and product capabilities such as capital markets services. In each such case, our goal to offer increasingly comprehensive and valuable solutions to our clients will be combined with a disciplined approach to managing our financial resources and an insistence on hiring only top-tier talent. |

| • | Exploit Embedded Growth Opportunities. We intend to drive organic growth by exploiting opportunities that will arise from our separation from Blackstone, including relief from conflicts with Blackstone’s investing areas and an enhanced ability to compete for business from financial sponsors. For instance, we believe the ability to compete for strategic advisory engagements in transactions involving financial sponsors (which represented nearly a third of global M&A advisory volume by transaction value in 2014) unhindered by the inherent challenges of securing advisory assignments from Blackstone competitors increases by approximately 50% the addressable market of our strategic advisory services. The opportunities of our funds advisory services business have similarly been constrained as some other sponsors have been reluctant to hire us to assist with their fundraising needs. Finally, Blackstone’s ability to hire us for advisory and placement assignments will no longer be impacted by actual or perceived conflicts of interest following the spin-off. |

| • | Attract and Retain Best-in-Class Talent. The creativity, insightfulness and clarity of our advice, and the trusted client relationships it inspires, are the foundation of our business. We will continue to focus |

3

| on hiring and retaining top-quality practitioners with expertise and relationships in new industries, products and geographies where we perceive an opportunity to fulfill existing or emerging client needs. We believe that the opportunity to practice at a dedicated advisory firm whose core mission is providing client-focused advice and solutions is a compelling proposition for practitioners that increasingly seek to leave behind large financial institutions. Moreover, while we and PJT Capital have enjoyed great success recruiting, we believe that the freedom from conflicts and increased addressable market that will result from the spin-off will make our firm even more attractive to new hires. |

| • | Leverage Our Diverse Platform. We have developed a scaled, diversified global advisory franchise comprised of complementary businesses, which each share our culture of excellence, teamwork and entrepreneurship. We are focused on maintaining the market leadership of our restructuring and reorganization and funds advisory services businesses in order to complement our world-class strategic advisory franchise, offering our clients a comprehensive and differentiated suite of independent advisory services and enhancing the stability of our revenue stream. As one firm, we intend to leverage the diverse capabilities and relationships of each business to deliver value for our clients. |

Competitive Strengths

We intend to execute on our strategy by capitalizing on the following core strengths of our organization:

| • | Trusted Advisors with Proven Track Records. We are recognized experts in strategic advisory, restructuring and reorganization and funds advisory services. Our teams act as trusted advisors to a diverse group of clients around the world. We provide clients with creative solutions addressing a range of complex strategic and fundraising challenges. With 11 offices spanning the globe, we have advised on or served as placement agent on: |

| • | more than 292 announced M&A transactions with a total value of more than $600 billion; |

| • | more than 400 distressed situations, both in and out of bankruptcy, involving more than $1.5 trillion of total liabilities; and |

| • | fundraising for 194 funds that have raised approximately $261 billion for a diverse range of investment strategies. |

Through our spin-off and combination with PJT Capital, we believe we can harness the legacy, scale and scope of a well-established business while capturing the entrepreneurial energy of a new firm.

| • | Complementary Business Lines. Our unique and highly differentiated portfolio of industry, product, and geographical expertise will better enable us to serve our clients. Our partners and team members have relationships with hundreds of corporate executives, board members, financial sponsors and governments as well as expertise in multiple product areas, industry verticals and geographies. Through our Park Hill Group business, we have relationships with over 3,000 different institutional investors, who collectively manage over $75 trillion of capital. These unique relationships and capabilities have the potential to help us drive incremental value for clients, and growth for our company, as we operate in a more integrated and cohesive manner. |

| • | Veteran Team of Practitioners. As of June 30, 2015, our team consisted of 235 professionals, including 31 partners, each with an average of over 20 years of relevant experience. Many of our partners are recognized leaders in their particular areas of expertise. Our partners share a culture of being practitioners first; consistently demonstrating an active, hands-on, high-touch approach to serving clients. Our professionals adhere to core principles: prioritizing our client’s interests, providing superior client service, protecting client confidentiality and avoiding conflicts of interest. |

| • | Experienced Leadership to Drive Profitable Growth. Our team will be led by Mr. Taubman, one of the preeminent investment bankers in the world. Mr. Taubman is a proven leader with the experience and |

4

| skill to lead PJT Partners in its new life as an independent public company, in addition to actively advising our firm’s clients. We anticipate he will continue his success in attracting and retaining new talent that is increasingly seeking to leave large financial institutions in favor of dedicated advisory firms. |

Industry Trends

We believe we are well-positioned to take advantage of the following favorable trends in our industry:

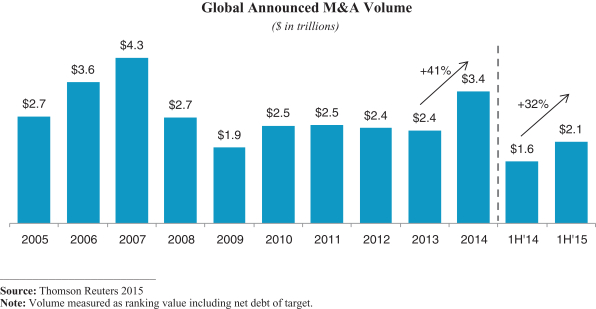

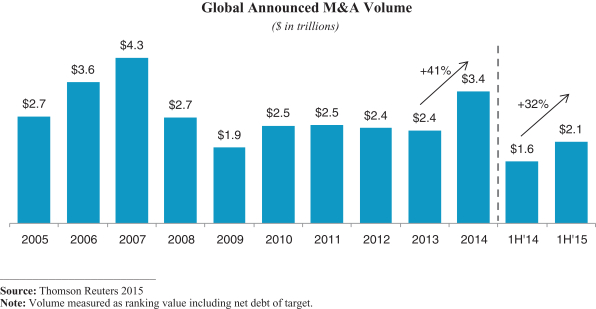

| • | Robust Mergers & Acquisitions Activity. M&A volume globally for 2014 and the first half of 2015 was up 41% and 32%, respectively, as compared to 2013 and the first half of 2014, respectively, and 2014 was the most active year since 2007. We expect this trend to continue as a result of an improving global macroeconomic environment, strong corporate balance sheets, a trend toward global consolidation and an environment in which companies are increasingly pursuing strategic acquisitions as part of their growth strategy. M&A volume is subject to periodic fluctuation based on a variety of factors, including conditions in the credit markets and other macroeconomic factors. For instance, recent periods have seen a decline in the number of leveraged buyouts in excess of certain debt levels due in part to the implementation of guidance from U.S. federal banking agencies with regard to leveraged lending practices. However, we believe there continue to be ample opportunities for sponsor M&A activity. Moreover, we believe such constraints have had very little impact, if any, on M&A volumes more generally. |

The chart below depicts global announced M&A volume over the past ten years and the first half of 2015.

5

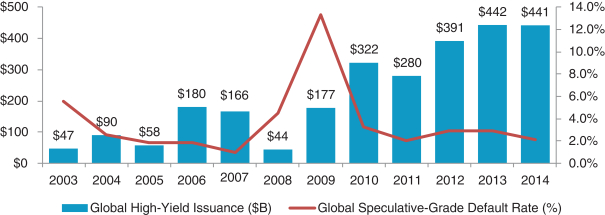

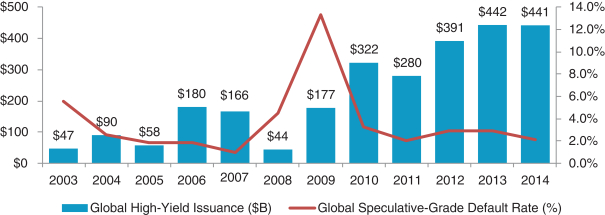

| • | Active Debt Markets to Drive Future Restructuring and Reorganization Activity. Both 2012 and 2013 represented record years for leveraged finance issuance in the United States as companies took advantage of historically low borrowing costs to leverage their capital structures. Given the lag between high-yield issuance and default rates, today’s historical level of current issuance should create a favorable environment for our Restructuring and Reorganization business in future periods. Moreover, we believe that restructuring activity in recent periods has been approaching a cyclical low, with high-yield default rates well below their long-term historical averages and strong demand for high-yield credit providing liquidity and access to capital for companies looking to refinance near-term maturities. We believe our leading Restructuring and Reorganization advisory franchise will position us well to capitalize on a future upturn in restructuring activity when corporate default rates moderate back to their long-term averages. |

The chart below depicts the volume of global high-yield debt issuance and the default rate for speculative-grade debt since 2003.

Global High-Yield Issuance and Default Rate

($ in billions)

Source: Thomson Reuters 2015, Moody’s Annual Default Study 2015

6

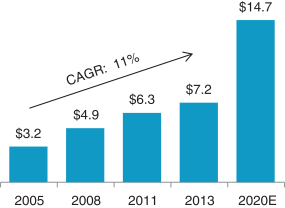

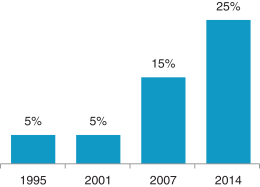

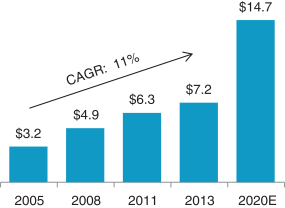

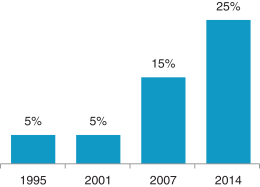

| • | Increasing Importance of Alternative Assets Driving Demand for Capital Raising Services. McKinsey and Co. estimates that global alternative assets under management (“AUM”) has grown from $3.2 trillion in 2005 to $7.2 trillion in 2013, representing a compound annual growth of 11%. Moreover, institutional investors have allocated increasingly larger portions of their portfolios to alternative asset classes. The allocation to alternative assets in pension fund portfolios increased from 5% in 2001 to 25% in 2014. |

| Global AUM of Alternative Assets ($ in trillions)

|

Pension Asset Allocation to Alternative Assets (Average percent of total portfolio AUM)

| |

|

| |

|

Source: McKinsey, The Trillion-Dollar Convergence: Capturing the Next Wave of Growth in Alternative Investments, August 2014 |

Source: Towers Watson, Global Pension Assets Study 2015, February 2015 |

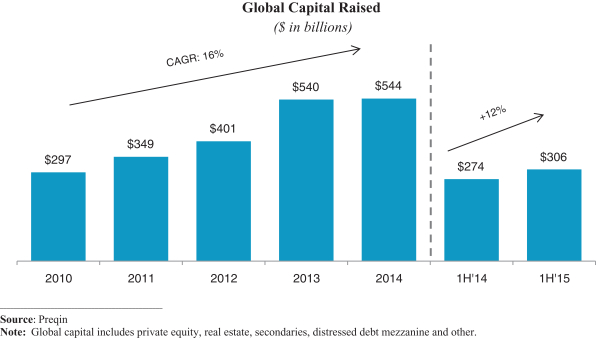

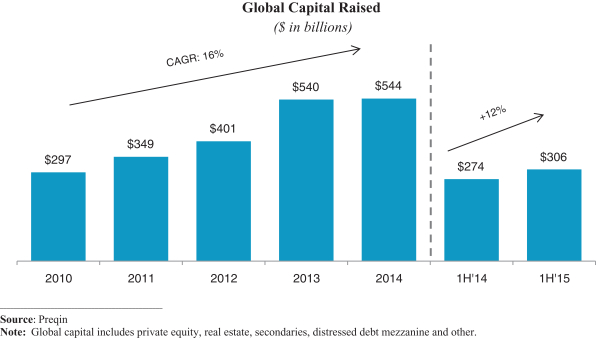

In addition, as illustrated in the chart below, greater investor demand has led to a 16% compound annual growth rate in global capital raising for alternative investment strategies over the last five years, and in the first half of 2015 increased 12% as compared to the first half of 2014.

7

We expect this current trend will continue as the combination of volatile returns in public equities and low yields on traditional fixed income investments shifts investor focus to the lower correlated and absolute levels of returns offered by alternative assets. As a leading alternative asset fundraising platform, Park Hill Group is well-positioned to benefit from this tailwind. In addition, as an independent firm, Park Hill Group will be even better positioned to foster relationships with additional alternative asset managers who were previously reluctant to hire Park Hill Group when it was a part of Blackstone.

| • | Growing Demand for Dedicated Advisory Services. Demand for dedicated advisory services has increased significantly over the past several years. Since 2003, dedicated advisory firms have increased their market share of global M&A volume significantly from 19% to 34%. In 2014, 60% of the top 10 announced M&A deals and 60% of the top 20 announced M&A deals included a dedicated advisory firm. In addition, over the past five years, the great majority of restructurings with an announced restructuring value of at least $100 million have included a dedicated advisory firm. We believe this is the result of a growing market preference for firms whose core mission is providing client-focused advice and solutions, free from the conflicts at large financial institutions where sizable sales and trading, underwriting and lending businesses coexist with an advisory business that comprises only a small portion of revenues and profits. |

| • | Ongoing Challenges at Large Financial Institutions. We will seek to continue to take advantage of growth opportunities arising from the ongoing challenges at large financial institutions. These firms face increasing regulation leading to higher operating costs, compensation limitations and increased capital constraints, all of which we believe adversely affect their ability to serve clients and compete to attract and retain talented professionals. In addition, such institutions must devote substantial resources and attention to the management of internal conflicts associated with lending to clients or potential clients of their advisory businesses or trading in their securities. We believe dislocation at large financial institutions has led to an increased exodus of senior advisory talent and that we are well-positioned to take advantage of this trend as we seek to attract and retain top-tier professionals. |

The Spin-Off

Overview

On October 7, 2014, the board of directors of Blackstone Group Management L.L.C. approved a plan to separate Blackstone’s financial and strategic advisory services, restructuring and reorganization advisory services and Park Hill Group businesses from Blackstone to form PJT Partners, following which PJT Partners will be an independent, publicly traded company.

In connection with the spin-off and the retention of Paul J. Taubman as our Chairman and CEO, we and Blackstone have entered into a transaction agreement (as it may be amended, the “Transaction Agreement”) with Mr. Taubman, PJT Capital LP and the other parties thereto, pursuant to which we will acquire, on the terms and subject to the conditions set forth in the Transaction Agreement, all of the outstanding equity interests in PJT Capital. Throughout this information statement, we refer to this transaction as the “acquisition.”

In connection with the spin-off, and as contemplated by the Transaction Agreement, we will enter into a Separation and Distribution Agreement (the “Separation Agreement”) and several other agreements with Blackstone related to the spin-off. These agreements will set forth the principal transactions required to effect our separation from Blackstone and provide for the allocation between us and Blackstone of various assets, liabilities, rights and obligations (including employee benefits and tax-related assets and liabilities) and govern the relationship between us and Blackstone after completion of the spin-off. These agreements will also include

8

arrangements with respect to transitional services to be provided by Blackstone to PJT Partners. See “Certain Relationships and Related Party Transactions—Agreements with Blackstone Related to the Spin-Off—Transition Services Agreement.”

The spin-off, including the consummation of the acquisition and the distribution of shares of Class A common stock of PJT Partners Inc. as described in this information statement is subject to the satisfaction or waiver of certain conditions. In addition, we, Blackstone and Mr. Taubman have the right to terminate the Transaction Agreement and abandon the spin-off in certain circumstances, as described in this information statement. See “The Spin-Off—Conditions to the Spin-Off” and “—Termination and Abandonment of the Spin-Off.”

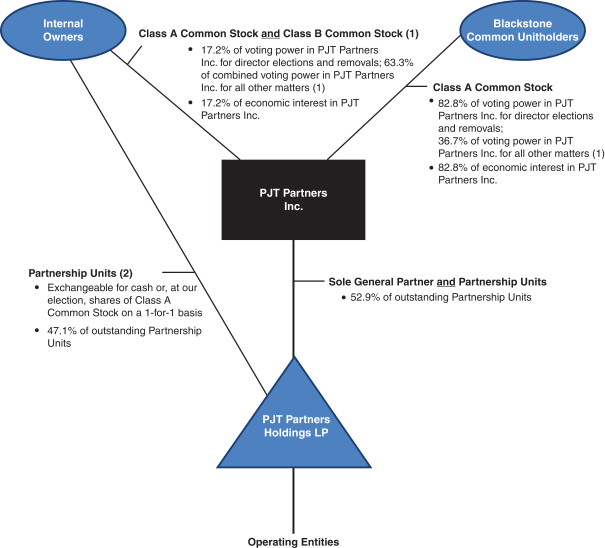

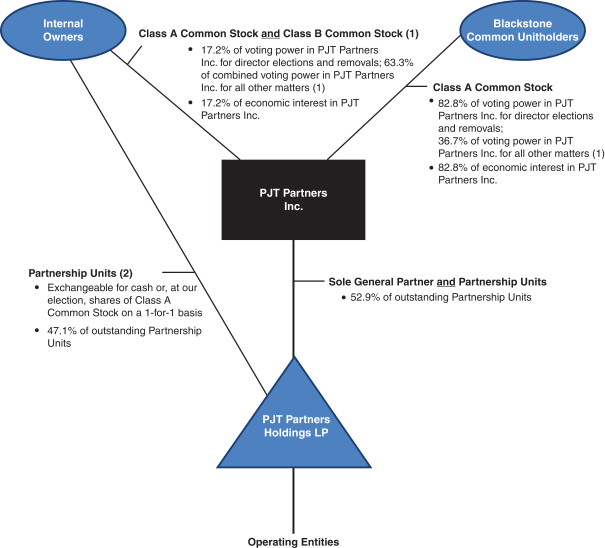

Organizational Structure Following the Spin-Off

In connection with the spin-off, Blackstone will undergo an internal reorganization, pursuant to which the operations that have historically constituted Blackstone’s Financial Advisory reporting segment, other than Blackstone’s capital markets services business, will be contributed to PJT Partners Holdings LP, a newly-formed holding partnership that will be controlled by PJT Partners Inc., as general partner. Blackstone’s capital markets services business, which has historically derived a majority of its revenue from transactions involving portfolio companies or investment funds of Blackstone, will not be contributed to PJT Partners Holdings LP, and Blackstone will retain this business following completion of the spin-off. In the internal reorganization, the limited partners of the holding partnerships that own Blackstone’s operating subsidiaries (the “Blackstone Holdings partnerships”) and certain individuals engaged in our business will receive Class A common stock of PJT Partners Inc., as well as common units of partnership interest in PJT Partners Holdings LP (“Partnership Units”) that, subject to certain terms and conditions, are exchangeable at the option of the holder for cash, or, at our election, for shares of our Class A common stock on a one-for-one basis. In addition, in connection with the spin-off, PJT Partners personnel will receive various types of awards under our 2015 Omnibus Incentive Plan denominated in shares of Class A common stock of PJT Partners Inc. and partnership interests in PJT Partners Holdings LP. See “Certain Relationships and Related Party Transactions—Transaction Agreement” and “—Agreements with Blackstone Related to the Spin-Off—Employee Matters Agreement” for additional information.

Prior to the distribution, PJT Partners Holdings LP will acquire, on the terms and subject to the conditions set forth in the Transaction Agreement, all of the outstanding equity interests in PJT Capital LP. In connection with the acquisition, Mr. Taubman and the other partners and employees of PJT Capital LP will receive unvested Partnership Units and other partnership interests in PJT Partners Holdings LP. Throughout this information statement, we use the term “internal owners” to refer collectively to (1) the limited partners of the Blackstone Holdings partnerships and certain individuals engaged in our business that will receive Class A common stock of PJT Partners Inc. and Partnership Units and other partnership interests in PJT Partners Holdings LP in the internal reorganization; and (2) Mr. Taubman and the other partners and employees of PJT Capital LP who will receive Partnership Units and other partnership interests in PJT Partners Holdings LP upon consummation of the acquisition.

Following the internal reorganization and the acquisition, The Blackstone Group L.P. will distribute on a pro rata basis to its common unitholders, all of the issued and outstanding Class A common stock of PJT Partners Inc. held by it.

Following the spin-off, PJT Partners Inc. will be a holding company and its only material asset will be its controlling equity interest in PJT Partners Holdings LP. As the sole general partner of PJT Partners Holdings LP, PJT Partners Inc. will operate and control all of the business and affairs and consolidate the financial results of PJT Partners Holdings LP and its subsidiaries. The ownership interest of the holders of Partnership Units (other than PJT Partners Inc.) will be reflected as a non-controlling interest in PJT Partners Inc.’s consolidated financial statements.

9

Our internal owners will also hold all issued and outstanding shares of the Class B common stock of PJT Partners Inc. The shares of Class B common stock will have no economic rights but will entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes that is equal to the aggregate number of vested and unvested Partnership Units and LTIP Units in PJT Partners Holdings LP held by such holder on all matters presented to stockholders of PJT Partners Inc. other than director elections and removals. With respect to the election and removal of directors of PJT Partners Inc., shares of Class B common stock will initially entitle holders to only one vote per share, representing significantly less than one percent of the voting power entitled to vote thereon. However, the voting power of Class B common stock with respect to the election and removal of directors of PJT Partners Inc. may be increased to up to the number of votes to which a holder is then entitled on all other matters presented to stockholders, as described under “Description of Capital Stock—Class B Common Stock.” The voting power on applicable matters afforded to holders of partnership interests by their shares of Class B common stock is automatically and correspondingly reduced as they exchange Partnership Units for cash or for shares of Class A common stock of PJT Partners Inc. pursuant to the exchange agreement described below. If at any time the ratio at which Partnership Units are exchangeable for shares of Class A common stock of PJT Partners Inc. changes from one-for-one as described under “Certain Relationships and Related Person Transactions—Exchange Agreement,” the number of votes to which Class B common stockholders are entitled on applicable matters will be adjusted accordingly. Holders of shares of our Class B common stock will vote together with holders of our Class A common stock as a single class on all matters on which stockholders are entitled to vote generally, except as otherwise required by law. Blackstone’s senior management, including Mr. Schwarzman and all of Blackstone’s other executive officers, will provide an irrevocable proxy to Mr. Taubman to vote their shares of Class B common stock for so long as Mr. Taubman is the CEO of PJT Partners Inc.

We and the internal owners will also enter into an exchange agreement under which they (or certain permitted transferees) will have the right, subject to the terms and conditions set forth in the partnership agreement of PJT Partners Holdings LP, on a quarterly basis, from and after the first anniversary of the date of the consummation of the spin-off (subject to the terms of the exchange agreement), to exchange all or part of their Partnership Units for cash or, at our election, for shares of our Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for splits, unit distributions and reclassifications. The price per Partnership Unit to be received in a cash-settled exchange will be equal to the fair value of a share of our Class A common stock (determined in accordance with and subject to adjustment under the exchange agreement). In the event that PJT Partners Inc. elects to fund cash-settled exchanges of Partnership Units with new issuances of Class A common stock, the fair value of a share of our Class A common stock will be deemed to be equal to the net proceeds per share of Class A common stock received by PJT Partners Inc. in the related issuance. Accordingly, in this event, the price per Partnership Unit to which an exchanging Partnership Unitholder will be entitled may be greater than or less than the then-current market value of our Class A common stock. See “Certain Relationships and Related Person Transactions— Exchange Agreement.”

10

The diagram below depicts our organizational structure immediately following the spin-off. For additional detail, see “The Spin-Off—Organizational Structure Following the Spin-Off.” Unless otherwise indicated, the information in the diagram below does not reflect shares of Class A common stock and Partnership Units that may be issued upon settlement of awards under our 2015 Omnibus Incentive Plan (or upon conversion of interests granted thereunder). See “Certain Relationships and Related Party Transactions—Transaction Agreement—Founder Earn-Out Units,” “—Agreements with Blackstone Related to the Spin-Off—Employee Matters Agreement” and “Management—Director Compensation” for additional information.

| (1) | The shares of Class B common stock will have no economic rights but will entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes that is equal to the aggregate number of vested and unvested Partnership Units and LTIP Units in PJT Partners Holdings LP held by such holder, if any, on all matters presented to stockholders of PJT Partners Inc. other than director elections and removals. With respect to the election of directors of PJT Partners Inc., shares of Class B common stock will initially entitle holders to only one vote per share, representing significantly less than one percent of the voting power entitled to vote thereon. However, the voting power of Class B common stock with respect to |

11

| the election and removal of directors of PJT Partners Inc. may be increased to up to the number of votes to which a holder is then entitled on all other matters presented to stockholders, as described under “Description of Capital Stock—Common Stock—Class B Common Stock.” Blackstone’s senior management, including Mr. Schwarzman and all of Blackstone’s other executive officers, will provide an irrevocable proxy to Mr. Taubman to vote their shares of Class B common stock for so long as Mr. Taubman is the CEO of PJT Partners Inc. For additional information, see “The Spin-Off—Organizational Structure Following the Spin-Off.” |

| (2) | Includes unvested partnership interests in PJT Partners Holdings LP that will be issued in the form of LTIP Units that will participate, from issuance, in all distributions by PJT Partners Holdings LP, other than liquidating distributions, ratably, on a per unit basis, with Partnership Units and will be subject to time-based vesting as described in “Management—Actions Taken in Anticipation of Separation—Partner Agreement with Paul J. Taubman—Founder Units.” Such participating LTIP Units are referred to herein as “Participating LTIP Units.” See “Certain Relationships and Related Party Transactions—Transaction Agreement” and “—PJT Partners Holdings LP Limited Partnership Agreement.” |

12

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies that are not emerging growth companies. These provisions include:

| • | exemptions from the requirements to hold non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; |

| • | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting; and |

| • | reduced disclosure about our executive compensation arrangements. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company upon the earliest of: (1) the end of the fiscal year following the fifth anniversary of the spin-off; (2) the first fiscal year after our annual gross revenues are $1.0 billion or more; (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; or (4) the date we become a “large accelerated filer” under the Exchange Act. We have taken advantage of reduced disclosure regarding executive compensation arrangements in this information statement, and we may choose to take advantage of some but not all of these reduced disclosure obligations in future filings while we remain an emerging growth company. If we do, the information that we provide stockholders may be different than you might get from other public companies in which you hold stock.

The JOBS Act permits an emerging growth company such as us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have chosen to “opt out” of this provision and, as a result, we will comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period under the JOBS Act is irrevocable.

PJT Partners Inc. (formerly known as Blackstone Advisory Inc.) was incorporated in the State of Delaware on November 5, 2014 and changed its name to PJT Partners Inc. on March 3, 2015. Our headquarters are located at 280 Park Avenue, New York, New York 10017. Our telephone number is (212) 364-7800.

Questions and Answers About the Spin-Off

The following provides only a summary of the terms of the spin-off. For a more detailed description of the matters described below, see “The Spin-Off.”

| Q: | What is the spin-off? |

| A: | The spin-off is the series of transactions by which the Blackstone’s financial and strategic advisory services, restructuring and reorganization advisory services and Park Hill Group businesses will be separated from Blackstone to form PJT Partners, an independent, publicly traded company. On the distribution date, The Blackstone Group L.P. will distribute on a pro rata basis to its common unitholders all of the issued and |

13

| outstanding shares of Class A common stock of PJT Partners Inc. held by it, as described in “The Spin-Off—Manner of Effecting the Spin-Off—Internal Reorganization” and “—Organizational Structure Following the Spin-Off.” We refer to this as the distribution. Following the spin-off, PJT Partners will be a separate company from Blackstone, and Blackstone will not retain any ownership interest in PJT Partners. |

| Q: | Why has Blackstone determined to separate the advisory businesses from the rest of the firm? |

| A: | The board of directors of Blackstone Group Management L.L.C. has determined that the separation of the advisory businesses is in the best interests of Blackstone, its common unitholders and other stakeholders because such separation will provide the following key benefits: |

| • | Relief from Conflict-related Constraints on Growth and Greater Strategic Focus of Management’s Efforts and Resources. Separation from Blackstone will meaningfully enhance our opportunities for organic growth, including by eliminating conflicts with Blackstone’s investing areas and enhancing our ability to compete for business from financial sponsors. As a part of Blackstone, our professionals have been effectively precluded from competing for strategic advisory and restructuring engagements in many transactions where the potential for an investment by a Blackstone fund created an actual or perceived conflict of interest. As Blackstone’s investing businesses have grown broader and larger, the potential for such conflicts has grown commensurately, with the result that Blackstone has not been free to aggressively grow our advisory business out of concern for compounding such conflicts. As an independent firm, free from such conflicts, we believe that we will be able to more effectively compete for new client engagements and significantly expand our platform into new product industries and transaction execution capabilities. Moreover, we will be free to compete for advisory and placement assignments from financial sponsors unhindered by the inherent challenges of securing such assignments from Blackstone competitors. |

In addition, Blackstone will be better positioned to devote its full efforts and resources toward the unrestricted growth of its core asset management businesses and better serving its fund investors, free from conflict management and other challenges caused by being a part of a combined enterprise with our advisory businesses.

| • | Unlocking Multiple Value. We believe that peer advisory firms of PJT Partners have historically traded at significantly higher earnings multiples than asset managers. As a pure-play advisory business, we believe this value will be unlocked to the benefit of PJT Partners’ owners, including the common unitholders of Blackstone. |

| • | Improved Management Incentive Tools. In multi-business companies such as Blackstone, it is difficult to structure incentives that reward professionals in a manner directly related to the performance of their respective business units. The spin-off will enable us to grant equity compensation to our senior management and other professionals tied directly to our business, creating a strong alignment of interest with our public stockholders and resulting in incentives that will be less diluted and more effective. |

| • | Enhanced Focus on Clients. Both Blackstone and we believe that, as a unified, independently managed, stand-alone company, our management will be able to more closely align internal resources, including senior management time, with the unique priorities of the clients of our business. |

| • | Ability to Utilize Equity as an Acquisition Currency. The spin-off will enable us to use our equity as currency to pursue certain financial and strategic objectives, including tax-free merger transactions. In addition, future strategic transactions with similar businesses will be more easily facilitated through the use of our equity as consideration. |

14

| Q: | Why is the separation of Blackstone’s advisory businesses structured as a spin-off? |

| A: | On October 7, 2014, the board of directors of Blackstone Group Management L.L.C. approved a plan to separate Blackstone’s financial and strategic advisory services, restructuring and reorganization advisory services and Park Hill Group businesses from Blackstone to form PJT Partners. Blackstone determined, and continues to believe, that a spin-off is the method of separation that is most advantageous to its common unitholders by enabling them to share in the growth of the business that the separation will afford. Blackstone also believes that a spin-off is the most efficient way to accomplish this separation for various reasons, including that: (1) a spin-off would enable our business to be separated from Blackstone in a manner that is expected to be generally tax-free; and (2) a spin-off offers a higher degree of certainty of completion in a timely manner, lessening disruption to current business operations. After consideration of strategic alternatives, Blackstone believes that a spin-off will enhance the long-term value of both Blackstone and PJT Partners. See “The Spin-Off—Reasons for the Spin-Off.” |

| Q: | What will I receive in the spin-off? |

| A: | As a holder of Blackstone common units, you will retain your Blackstone common units and will receive one share of Class A common stock of PJT Partners Inc. for every 40 common units of Blackstone you own as of the record date. The number of Blackstone common units you own and your proportionate interest in Blackstone will not change as a result of the spin-off. See “The Spin-Off.” |

| Q: | Will Blackstone retain any ownership of PJT Partners following the spin-off? |

| A: | Immediately upon consummation of the spin-off, PJT Partners will be owned entirely by Blackstone’s unitholders and the professionals engaged in our business. Blackstone will not retain any ownership interest in us immediately following the spin-off. |

| Q: | Are there any conditions to the consummation of the spin-off? |

| A: | Yes. The spin-off, including the consummation of the acquisition and the distribution of shares of Class A common stock of PJT Partners Inc. is subject to the satisfaction or waiver of certain conditions, as described in this information statement. In addition, we, Blackstone and Mr. Taubman have the right to terminate the Transaction Agreement and abandon the spin-off in certain circumstances, as described in this information statement. See “The Spin-Off—Conditions to the Spin-Off” and “—Termination and Abandonment of the Spin-Off.” |

| Q: | What will be the organizational structure of PJT Partners following the spin-off? |

| A: | Following the spin-off, PJT Partners will be organized in an “UP-C” structure. Accordingly, upon completion of the spin-off, PJT Partners Inc. will be a holding company and its only material asset will be its controlling equity interest in PJT Partners Holdings LP, a holding partnership that will hold PJT Partners’ operating subsidiaries. As the sole general partner of PJT Partners Holdings LP, PJT Partners Inc. will operate and control all of the business and affairs and consolidate the financial results of PJT Partners Holdings LP and its subsidiaries. The ownership interest of the holders of Partnership Units (other than PJT Partners Inc.) will be reflected as a non-controlling interest in PJT Partners Inc.’s consolidated financial statements. Subject to certain terms and conditions, the Partnership Units in PJT Partners Holdings LP are exchangeable at the option of the holder for a cash amount equal to the then-current market value of an equal number of shares of our Class A common stock, or, at our election, for shares of our Class A common stock on a one-for-one basis. Each Partnership Unit will have attached to it a preferred unit purchase right as further described in “Certain Relationships and Related Party Transactions—PJT Partners Holdings LP Limited Partnership Agreement.” For additional information, see “The Spin-Off—Organizational Structure Following the Spin-Off.” |

15

| Q: | What is being distributed in the spin-off? |

| A: | Upon consummation of the spin-off: |

| • | PJT Partners Holdings LP is expected to have a total of 34.0 million Partnership Units issued and outstanding, of which: |

| • | 16.0 million Partnership Units (or 47.1%) will be held by our internal owners; and |

| • | 18.0 million Partnership Units (or 52.9%) will be held by PJT Partners Inc.; and |

| • | PJT Partners Inc. is expected to have a total of 18.0 million shares of Class A common stock issued and outstanding, of which: |

| • | 3.1 million shares (or 17.2%) will be held by our internal owners; and |

| • | 14.9 million shares (or 82.8%) will be distributed to the common unitholders of Blackstone in the spin-off. |

The number of shares of Class A common stock to be distributed to the common unitholders of Blackstone is based on the number of common units of Blackstone expected to be outstanding as of September 22, 2015, the record date, and assuming a distribution ratio of one share of Class A common stock of PJT Partners Inc. for every 40 common units of The Blackstone Group L.P. held. Accordingly, upon consummation of the spin-off, the shares of Class A common stock of PJT Partners Inc. to be received by Blackstone common unitholders is expected to represent 82.8% of the economic interest in PJT Partners Inc. (43.8% of the economic interest in the PJT Partners business). The exact number of shares of Class A common stock of PJT Partners Inc. to be distributed will be calculated on the record date and will reflect any repurchases of common units of Blackstone and issuances of common units of Blackstone, including issuances in connection with the exchange of Blackstone Holdings partnership units and in respect of Blackstone equity incentive plans between the date the board of directors of Blackstone Group Management L.L.C. declares the dividend for the distribution and the record date for the distribution.

Our internal owners will also hold all of the issued and outstanding shares of Class B common stock of PJT Partners Inc., which have no economic rights but entitle the holder, without regard to the number of shares of Class B common stock held, to a number of votes on matters presented to stockholders of PJT Partners Inc. that is equal to the aggregate number of vested and unvested Partnership Units and LTIP Units in PJT Partners Holdings LP held by such holder on all matters presented to stockholders of PJT Partners Inc. other than director elections and removals. With respect to the election and removal of directors of PJT Partners Inc., shares of Class B common stock will initially entitle holders to only one vote per share, representing significantly less than one percent of the voting power entitled to vote thereon. However, the voting power of Class B common stock with respect to the election and removal of directors of PJT Partners Inc. may be increased to up to the number of votes to which a holder is then entitled on all other matters presented to stockholders, as described under “Description of Capital Stock—Common Stock—Class B Common Stock.” Blackstone’s senior management, including Mr. Schwarzman and all of Blackstone’s other executive officers, will provide an irrevocable proxy to Mr. Taubman to vote their shares of Class B common stock for so long as Mr. Taubman is the CEO of PJT Partners Inc.

Accordingly, upon consummation of the spin-off, and based on the assumptions described above regarding the shares outstanding on the record date and the distribution ratio, the shares of Class A common stock of PJT Partners Inc. to be received by Blackstone common unitholders is expected to represent:

| • | 82.8% of the voting power in PJT Partners Inc. with regard to the election and removal of directors of PJT Partners Inc.; and |

| • | 36.7% of the voting power in PJT Partners Inc. with regard to all other matters presented to stockholders of PJT Partners Inc. |

16

The foregoing discussion gives effect to the issuance of Participating LTIP Units, as described in “Certain Relationships and Related Party Transactions—PJT Partners Holdings LP Limited Partnership Agreement,” but does not otherwise reflect shares of Class A common stock and Partnership Units that may be issued upon settlement of awards under our 2015 Omnibus Incentive Plan (or upon conversion of interests granted thereunder). See “Certain Relationships and Related Party Transactions—Transaction Agreement—Founder Earn-Out Units,” “—Agreements with Blackstone Related to the Spin-Off—Employee Matters Agreement” and “Management—Director Compensation” for additional information.

See “The Spin-Off—Manner of Effecting the Spin-Off—Internal Reorganization” and “—Organizational Structure Following the Spin-Off” and “Description of Capital Stock—Common Stock” for additional information.

| Q: | When is the record date for the distribution? |

| A: | The record date is September 22, 2015. |

| Q: | When will the distribution occur? |

| A: | The distribution date of the spin-off is October 1, 2015. We expect that it will take the distribution agent, acting on behalf of Blackstone, up to two weeks after the distribution date to fully distribute the shares of Class A common stock of PJT Partners Inc. to Blackstone common unitholders. |

| Q: | What do I have to do to participate in the spin-off? |

| A: | Nothing. You are not required to take any action, although you are urged to read this entire document carefully. No approval by Blackstone common unitholders of the spin-off, including the consummation of the acquisition and the distribution, is required or sought. You are not being asked for a proxy. No action is required on your part to receive your shares of Class A common stock of PJT Partners Inc. You will neither be required to pay anything for the new shares nor be required to surrender any common units of Blackstone to participate in the spin-off. |

| Q: | How will fractional shares be treated in the spin-off? |

| A: | Fractional shares of Class A common stock of PJT Partners Inc. will not be distributed. Fractional shares of Class A common stock of PJT Partners Inc. to which Blackstone common unitholders of record would otherwise be entitled will be aggregated and sold in the public market by the distribution agent at prevailing market prices. The aggregate net cash proceeds of the sales will be distributed ratably to those common unitholders who would otherwise have received fractional shares of Class A common stock of PJT Partners Inc. See “The Spin-Off—Treatment of Fractional Shares” for a more detailed explanation. Receipt of the proceeds from these sales will generally result in a taxable gain or loss to those common unitholders. Each common unitholder entitled to receive cash proceeds from these common units should consult his, her or its own tax advisor as to such common unitholder’s particular circumstances. The tax consequences of the spin-off are described in more detail under “The Spin-Off—U.S. Federal Income Tax Consequences of the Spin-Off.” |

| Q: | What are the U.S. Federal income tax consequences of the spin-off? |

| A: | The spin-off is expected to be tax-free to Blackstone’s common unitholders for U.S. Federal income tax purposes, except to the extent of any gain or loss recognized by a common unitholder as a result of any cash received in lieu of fractional shares. The spin-off is conditioned on the receipt by Blackstone of an opinion of tax counsel to the effect that certain transactions in the internal reorganization should qualify as tax-free distributions under Section 355 of the Internal Revenue Code of 1986, as amended (the “Code”) and that a certain transaction in the internal reorganization should qualify as a tax-free reorganization under Section 368 of the Code. Blackstone expects to receive such opinion at or prior to the time of the consummation of the spin-off. Although Blackstone has no current intention to do so, such condition is solely for the benefit of Blackstone and its common unitholders and may be waived by Blackstone with the consent of Mr. Taubman. The tax consequences of the spin-off are described in more detail under “The Spin-Off—U.S. Federal Income Tax Consequences of the Spin-Off.” |

17

| Q: | Will the Class A common stock of PJT Partners Inc. be listed on a stock exchange? |

| A: | Yes. Although there is not currently a public market for our Class A common stock, PJT Partners Inc. has been approved to list its Class A common stock on the New York Stock Exchange (the “NYSE”) under the symbol “PJT.” We anticipate that trading of Class A common stock of PJT Partners Inc. will commence on a “when-issued” basis at least two trading days prior to the record date. “When-issued” trading refers to a sale or purchase made conditionally because the security has been authorized but not yet issued. “When-issued” trades generally settle within four trading days after the distribution date. On the first trading day following the distribution date, any “when-issued” trading with respect to Class A common stock of PJT Partners Inc. will end and “regular-way” trading will begin. “Regular-way” trading refers to trading after a security has been issued and typically involves a transaction that settles on the third full trading day following the date of the transaction. See “Trading Market.” |

| Q: | Will my common units of Blackstone continue to trade? |

| A: | Yes. Blackstone common units will continue to be listed and trade on the NYSE under the symbol “BX.” |

| Q: | If I sell, on or before the distribution date, common units of Blackstone that I held on the record date, am I still entitled to receive shares of Class A common stock of PJT Partners Inc. distributable with respect to the common units of Blackstone that I sold? |

| A: | Beginning on or shortly before the record date and continuing through the distribution date for the spin-off, Blackstone common units will begin to trade in two markets on the New York Stock Exchange: a “regular-way” market and an “ex-distribution” market. If you hold common units of Blackstone as of the record date for the distribution and choose to sell those shares in the “regular-way” market after the record date for the distribution and on or before the distribution date, you also will be selling the right to receive the shares of Class A common stock of PJT Partners Inc. in connection with the spin-off. However, if you hold common units of Blackstone as of the record date for the distribution and choose to sell those common units in the “ex-distribution” market after the record date for the distribution and on or before the distribution date, you will still receive the shares of Class A common stock of PJT Partners Inc. in the spin-off. |

| Q: | Will the spin-off affect the trading price of my Blackstone common units? |

| A: | Yes, the trading price of common units of Blackstone immediately following the distribution is expected to be lower than immediately prior to the distribution because its trading price will no longer reflect the value of the PJT Partners business. However, we cannot predict the price at which the Blackstone common units will trade following the spin-off. |

| Q: | What indebtedness will PJT Partners have following the spin-off? |

| A: | We expect to procure, substantially concurrently with the completion of the spin-off, from one or more financing sources a revolving credit facility for PJT Partners Holdings LP in an aggregate principal amount of up to $80 million. We expect the revolving credit facility will mature on the second anniversary of the closing of the spin-off, subject to extension by agreement of the parties, and will be on market terms (including pricing). We do not expect to have any borrowings under the revolving credit facility outstanding upon consummation of the spin-off. |

| Q: | Who will comprise the senior management team after the spin-off? |

| A: | Our senior management team will be led by Paul J. Taubman who will serve as our Chairman and Chief Executive Officer. Before departing to found PJT Capital, Mr. Taubman spent 30 years at Morgan Stanley where he served as Co-President of the Institutional Securities Group. Prior to becoming Co-President, he |

18

| was the Head of Global Investment Banking and Head of its Global Mergers and Acquisitions Department. Mr. Taubman leads a talented team of executive officers that, collectively, have an average of 28 years of relevant experience. See “Management” for information on our executive officers. |

| Q: | What will PJT Partners’ dividend policy be after the spin-off? |

| A: | Subject to applicable law, we intend to pay a quarterly cash dividend to holders of our Class A common stock in an amount per share to be determined by our board of directors on a quarterly basis, commencing in the first quarter of 2016, and we may increase or decrease, or discontinue entirely the payment of such dividends at any time. From time to time, we may also repurchase our Class A common stock, subject to applicable law. The declaration, amount and payment of future dividends to holders of our Class A common stock and the amount, terms and conditions of any repurchase of our Class A common stock will be at the sole discretion of our board of directors and will depend on many factors, including our financial condition, earnings, cash flows, capital requirements, cash settlement of Partnership Unit exchanges, previous and anticipated amounts of dividend payments and share repurchases, level of indebtedness, statutory and contractual restrictions applicable to the payment of dividends, general economic, market and industry conditions, and other considerations that our board of directors deem relevant from time to time. See “Dividend Policy.” |

| Q: | What are the anti-takeover effects of the spin-off? |

| A: | Some provisions of the amended and restated certificate of incorporation of PJT Partners Inc. and the amended and restated bylaws of PJT Partners Inc., Delaware law and possibly the credit agreement governing PJT Partners’ new revolving credit facility, as each will be in effect immediately following the spin-off, may have the effect of making more difficult an acquisition of control of PJT Partners in a transaction not approved by PJT Partners Inc.’s board of directors. See “Description of Capital Stock—Anti-Takeover Effects of Our Amended and Restated Certificate of Incorporation, Our Amended and Restated Bylaws, Our Stockholder Rights Plan and Certain Provisions of Delaware Law.” |

In addition, as described below, at the request of Blackstone we will adopt a stockholder rights agreement to be executed prior to the spin-off. Although holders of shares of our Class B common stock will initially own in excess of 47.1% of the equity in our business by virtue of their ownership of Partnership Units in PJT Partners Holdings LP, their shares of Class B common stock will initially only entitle such holders to significantly less than one percent of the voting power for the election and removal of directors of PJT Partners Inc. Accordingly, in the absence of a rights plan, a short-term investor would be able to acquire an outsized percentage of the voting power for the election and removal of directors of PJT Partners Inc., and pursue an agenda that may not be in the long-term best interests of our company, without making a commensurately significant investment in the ownership of our business. Due to these highly unusual circumstances, Blackstone and we believe a stockholder rights agreement is prudent as it will permit our board of directors to manage our affairs for the long term benefit of our stockholders and allow all stockholders to realize the full value of their investment.

Our stockholder rights agreement provides recognized stockholder protections, including no features that would limit the ability of a future board of directors to redeem the rights or otherwise make the stockholder rights agreement non-applicable to a particular transaction prior to a person or group becoming an “acquiring person.”

Pursuant to the stockholder rights agreement, holders of our Class A common stock will be granted rights to purchase from us additional shares of our Class A common stock in the event that a person or group acquires beneficial ownership of 15% or more of the then-outstanding Class A common stock without approval of our board of directors, subject to exceptions for, among other things, persons beneficially owning 15% or more of our Class A common stock as of the date of the initial filing with the Securities and Exchange Commission (the “SEC”) of the Registration Statement on Form 10 of which this information statement forms a part (or that would beneficially own 15% or more of our Class A common stock by virtue

19