UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ | | | Filed by a party other than the Registrant ☐ |

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

☒ | | | No fee required. |

☐ | | | Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |  |

April 29, 2024

Dear Fellow Shareholders,

We cordially invite you to attend our 2024 Annual Meeting of Shareholders, to be held on June 20, 2024, at 10:00 a.m., Eastern Daylight Time. The Annual Meeting will be a virtual meeting of shareholders. You will be able to attend the Annual Meeting, vote your shares electronically and submit your questions during the meeting via live audio webcast by visiting http://www.virtualshareholdermeeting.com/PJT2024. To participate in the meeting, you must have your 16-Digit Control Number that is shown on your Notice of Internet Availability of Proxy Materials or on your proxy card if you elected to receive proxy materials by mail. You will not be able to attend the Annual Meeting in person.

The Notice of Annual Meeting of Shareholders and Proxy Statement that follow describe the business to be conducted at the Annual Meeting. Your vote is important. We encourage you to vote by proxy in advance of the Annual Meeting, whether or not you plan to participate.

Thank you for your continuing support of PJT Partners.

Very truly yours,

Paul J. Taubman

Chairman and Chief Executive Officer

280 Park Avenue | New York, NY 10017 | t. +1.212.364.7810 | pjtpartners.com

| | |  |

PJT Partners Inc.

280 Park Avenue, New York, New York 10017

Notice of 2024 Annual Meeting of Shareholders

Items of Business | | | Date: Thursday, June 20, 2024 |

Item 1. Election to the Board of Directors of three Class III director nominees identified in this Proxy Statement Item 2. Approval, on an advisory basis, of the compensation of our Named Executive Officers as disclosed in this Proxy Statement Item 3. Approval, on an advisory basis, of the frequency (every one, two or three years) of advisory votes to approve the compensation of our Named Executive Officers Item 4. Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2024 To transact such other business as may properly come before our Annual Meeting or any adjournments or postponements thereof. | | | Time: 10:00 a.m. Eastern Daylight Time Place: Virtual format only. If you plan to participate in the virtual meeting, please see “Participation in Our Annual Meeting” below. Shareholders will be able to participate, vote, examine the shareholders list and submit questions (both before, and for a portion of, the meeting) from any location via the Internet. Shareholders may participate by logging in at: www.virtualshareholdermeeting.com/PJT2024. To participate you must have your 16-Digit Control Number that is shown on your Notice of Internet Availability of Proxy Materials or on your proxy card if you elected to receive proxy materials by mail. Record Date: April 22, 2024 |

Your vote is important to us. Please exercise your shareholder right to vote.

By Order of the Board of Directors,

David K.F. Gillis

Corporate Secretary

April 29, 2024

Important Notice Regarding the Availability of Proxy Materials for our Annual Meeting to be held on June 20, 2024. Our Proxy Statement, 2023 Annual Report to Shareholders and other materials are available on our website at https://ir.pjtpartners.com/sec-filings/all-sec-filings. The Proxy Materials will be mailed or made available to our shareholders on or about April 29, 2024. We are sending to most of our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice of Availability”) rather than a paper set of the Proxy Materials. By doing so, we save costs and reduce our impact on the environment. The Notice of Availability includes instructions on how to access our Proxy Materials over the Internet, as well as how to request the materials in paper form. On or about April 29, 2024, we will mail to most of our shareholders the Notice of Availability.

| | |  |

| | |  |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | |  |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

Although we refer to websites and other documents in this Proxy Statement, the contents of such websites and documents are not included or incorporated by reference into this Proxy Statement. All references to websites in the Proxy Statement are intended to be inactive textual references only.

| | |  |

This summary highlights information from PJT Partners Inc.’s Proxy Statement for the 2024 Annual Meeting of Shareholders.1 You should read this entire Proxy Statement carefully before voting. Please refer to the Glossary of Terms in Appendix A for definitions of some of the terms used in this Proxy Statement. Your vote is important. For more information on voting and participating in the Annual Meeting, see, “Participation in Our Annual Meeting” below.

PJT Partners2 is a premier, global, advisory-focused investment bank that was built from the ground up to be different. Our highly experienced, collaborative teams provide independent advice coupled with old-world, high-touch client service. This ethos has allowed us to attract some of the very best talent in the markets in which we operate. We deliver leading advice to many of the world's most consequential companies, effect some of the most transformative transactions and restructurings and raise billions of dollars of capital around the globe to support startups and more established companies.

Financials | ||||||

$1.15bn Total Revenues, an increase of 12% YoY | | | 15.4% GAAP Pretax Margin 15.8% Adjusted4 Pretax Margin | | | $3.12 GAAP Diluted EPS $3.27 Adjusted4 EPS |

Capital Management | ||||||

2.2mm Share equivalents repurchased | | | $437mm Cash, cash equivalents and short-term investments; No funded debt | | | $1.00 Annual dividend per share |

1. | PJT Partners Inc. is a holding company, and its only material asset is its controlling equity interest in PJT Partners Holdings LP (“PJT Partners Holdings”), a holding partnership that holds the company’s operating subsidiaries, and certain cash and cash equivalents it may hold from time to time. As the sole general partner of PJT Partners Holdings, PJT Partners Inc. operates and controls all of the business and affairs and consolidates the financial results of PJT Partners Holdings and its operating subsidiaries. PJT Partners Inc.’s common stock trades on the New York Stock Exchange (“NYSE”) under the symbol “PJT.” |

2. | In this Proxy Statement, unless the context requires otherwise, the words “PJT Partners” refer to PJT Partners Inc. and the “company,” “we,” “us” and “our” refer to PJT Partners, together with its consolidated subsidiaries, including PJT Partners Holdings and its operating subsidiaries. |

3. | As of December 31, 2023. |

4. | Figures are shown ‘as adjusted,’ a non-GAAP financial measure. See Appendix B, “U.S. GAAP Reconciliations” for a reconciliation of non-GAAP financial measures with comparable GAAP financial measures. |

1

Executive Summary

| | |  |

Footprint | ||||||

115 Total Partners, an increase of 10% YoY | | | 1,012 Company-wide headcount, an increase of 12% YoY | | | 12 Offices worldwide; Opened Tokyo office in 2023 |

73 Strategic Advisory Partners, an increase of 11% YoY | | | | | ||

Corporate Sustainability and Community | ||||||

3rd Annual Corporate Sustainability Report released | | | >$7.9mm Company-wide giving since 2020 | | | >350 Charitable organizations supported by PJT |

The Board has nominated three directors, James Costos, Grace R. Skaugen and Kenneth C. Whitney, for election as Class III directors. If elected, each Class III director will serve until the annual meeting of shareholders in 2027, or until succeeded by another qualified director who has been elected.

The Board recommends that you vote “FOR” each director nominee.

Nominees for Class III Directors Whose Terms Will Expire in 2027

| | | James Costos | Age: 61 | Director since February 2017 Professional Highlights |

| | James Costos served as the United States Ambassador to the Kingdom of Spain and the Principality of Andorra from August 2013 to January 2017. Before his diplomatic service, he held leadership roles in the entertainment and international business sectors. Notably, Mr. Costos was Vice President at Home | ||

Box Office (HBO) from 2007 to 2013, and his executive experience also includes leadership positions at Revolution Studios, Tod’s S.p.A., and Hermès of Paris. Currently, Mr. Costos holds the position of President at Secuoya Studios, a global Spanish TV and film content production studio headquartered in Madrid. He also serves as a Senior Managing Director in the global venture technology group at Dentons, one of the world’s largest law firms. In addition to his professional endeavors, Mr. Costos is dedicated to cultural and humanitarian causes. He serves on the J. William Fulbright Foreign Scholarship Board and sits on the boards of the Hispanic Society of America and the Human Rights Campaign, the largest LGBTQ+ advocacy and political lobbying organization in the United States. Mr. Costos earned his Bachelor of Arts degree in Political Science from the University of Massachusetts. Skills & Qualifications Mr. Costos’ international government relations and policy experience, international marketing, operations, technology and executive leadership experience positions him well to serve on the Board. His strong international experience brings a geographically diverse perspective to the oversight of our multi-national business operations. | |||

2

Executive Summary

| | |  |

| | | Grace R. Skaugen | Age: 70 | Director since July 2020 Professional Highlights |

| | Grace Reksten Skaugen, a Norwegian national, has extensive experience working with a broad array of European companies. She currently chairs Orrön Energy AB (member of the Compensation Committee) and is a board member of Investor AB (Chair of the Audit and Risk Committee). Ms. Skaugen is also a | ||

trustee of the International Institute for Strategic Studies (IISS) in London. In 2009, Ms. Skaugen co-founded the Norwegian Institute of Directors, where she still serves on its board. She previously served as a senior advisor to HSBC (2014-2019) and Deutsche Bank (2007-2014). She was deputy chair (2012-2015) of the Norwegian oil company Statoil (now Equinor) and served on its board (2002-2015). Ms. Skaugen served as deputy chair (2013-2020), board member (2012-2020) and chair of the Compensation Committee at Orkla ASA, was a board member and member of the Compensation and Sustainability Committees at Lundin Energy AB (2015-2022) and chaired Euronav NV (where she was a member of the Compensation Committee, Sustainability Committee and Corporate Governance and Nomination Committee) (2016-2023). She has previous investment banking experience, having worked at the Nordic bank SEB, where she advised companies within the energy, transportation and technology sectors. Ms. Skaugen started her career as a postdoctoral researcher at Columbia Radiation Laboratory in New York. She is a physicist by education and holds a PhD in laser physics from Imperial College in London. She also holds an M.B.A. from the Norwegian School of Management, BI. Skills & Qualifications Ms. Skaugen’s experience and expertise in the international financial services industry, as well as her extensive corporate governance and board experience, provide unique insights into our business and add industry-specific expertise and knowledge to the Board. Her strong international experience brings a geographically diverse perspective to the oversight of our multi-national business operations. | |||

| | | Kenneth C. Whitney | Audit Committee Chair | Age: 66 | Director since October 2015 Professional Highlights |

| | Kenneth C. Whitney has managed a private family investment office since April 2013, focused on start-up businesses and entertainment projects. Since his retirement from Blackstone Inc. in April 2013 until September 2015, he was also | ||

a Senior Advisor to Blackstone. Mr. Whitney was previously a Senior Managing Director and Head of Blackstone’s Investor Relations & Business Development Group from 1998 to April 2013. After joining Blackstone in 1988, Mr. Whitney focused his efforts on raising capital for Blackstone’s private investment funds and the establishment of Blackstone affiliates in the alternative investment area. Mr. Whitney began his career at Coopers & Lybrand in 1980, where he spent time in the firm’s accounting and audit areas as well as in the tax and mergers and acquisitions areas. Mr. Whitney is a Tony Award-winning producer, and currently sits on the Board of Trustees for The First Tee and the University of Delaware, where he received a B.S. in Accounting. Skills & Qualifications Mr. Whitney’s experience and expertise in the private equity and financial services industry, as well as his extensive financial, accounting, operations and management experience, provide unique insights into our business and add industry-specific expertise and knowledge to the Board. | |||

3

Executive Summary

| | |  |

Board Diversity

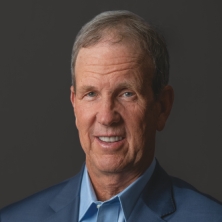

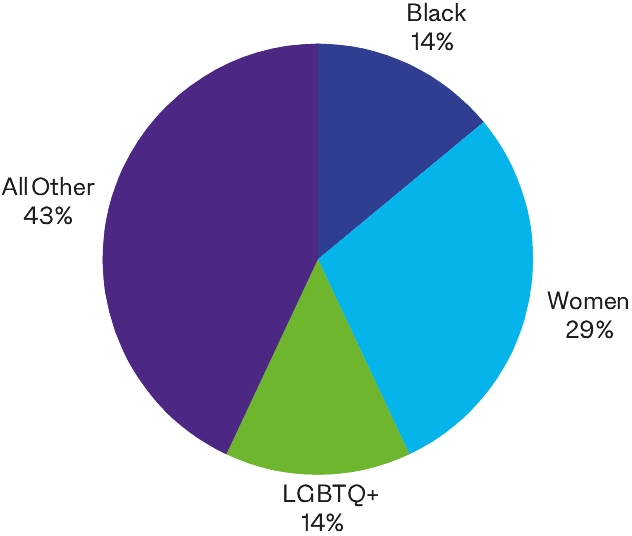

Our Board is composed of highly accomplished, actively engaged individuals with diverse skills, experiences and backgrounds who share our commitment to excellence, collaboration and integrity. The Board believes that fostering an inclusive culture both at the Board level and throughout the company enables us to provide the best advice and insights to our clients and better serve our stakeholders. The Board is making deliberate progress in seeking and electing new directors who enhance its composition and collective skills. In addition to contributing a variety of valuable experience and expertise, the three directors most recently elected to our Board all increased the racial, gender or LGBTQ+ diversity of the Board. Consistent with our commitment to continuous improvement, our Board annually assesses its collective diversity, experience and expertise, to check that these characteristics continue to align with our evolving business strategy and with the Board’s role in overseeing the company’s achievement of its long-term objectives. The Board comprises an inclusive mix of backgrounds and perspectives and includes two female directors, one Black director and one LGBTQ+ director. A majority of the Board — 57% — are members of groups that are historically underrepresented on public company boards:

The Board recommends that you vote “FOR” the approval, on an advisory basis, of the compensation of our Named Executive Officers.

Key reasons to vote “FOR” the approval, on an advisory basis, of the compensation of our Named Executive Officers:

Our compensation program includes elements that are intended to ensure strong alignment between the interests of our Executive Officers and our shareholders:

> | Annual incentive compensation that places a strong emphasis on company-wide financial performance, with consideration given to the individual performance of each Executive Officer |

> | An appropriate link between compensation and the creation of shareholder value through long-term equity awards |

> | A focus on collaboration, and therefore does not include individual revenue pay-outs at any level |

> | Consideration for each executive’s contribution to leadership and talent development |

> | Benchmarking analysis to help us understand compensation practices of our competitors |

Our compensation program for our Executive Officers and the company overall also aims to be market- competitive versus our peers, in both quantum and structure to ensure that we are able to attract and retain executives and other professionals that contribute to the long-term success of the company.

4

Executive Summary

| | |  |

Proposal 3: Advisory Resolution on the Frequency of Future Advisory Resolutions on Executive Compensation

The Board recommends that you vote for holding of future advisory votes on the compensation of our Named Executive Officers every “1 YEAR.”

Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”) enables our shareholders to vote on a non-binding, advisory basis how frequently we will submit “Say on Pay” proposals (i.e., Proposal 2) to our shareholders in the future. Our shareholders have the following three alternatives to choose from: (1) every year (“1 year” on the proxy card), (2) every two years (“2 years” on the proxy card) or (3) every three years (“3 years” on the proxy card). In addition, our shareholders may choose to abstain from voting on this proposal.

The votes on Proposals 2 and 3 are advisory in nature and will not be binding on or overrule any decisions by the Board. Our Compensation Committee values the opinions expressed by our shareholders and will take into account the outcome of the votes in future compensation decisions and in determining the frequency of future advisory votes on executive compensation.

The Audit Committee has appointed Deloitte & Touche LLP (“Deloitte”) as the company’s independent registered public accounting firm to audit the Consolidated Financial Statements of PJT Partners Inc. and its subsidiaries for the year ending December 31, 2024. A resolution is being presented to our shareholders requesting ratification of the appointment of Deloitte.

The Board recommends that you vote “FOR” the ratification of the appointment of Deloitte as the company’s independent registered public accounting firm.

5

Executive Summary

| | |  |

Proposal 1: Election of Directors |

The Board has nominated three directors, James Costos, Grace R. Skaugen and Kenneth C. Whitney, for election as Class III directors. If elected, each Class III director will serve until the annual meeting of shareholders in 2027, or until succeeded by another qualified director who has been elected. |

Board Recommendation |

The Board recommends that you vote “FOR” all nominees. |

This section of our Proxy Statement contains information about the Board of Directors, including our nominees, and key elements of our corporate governance. The Board places great value on strong governance controls, and we have structured our corporate governance in a manner we believe closely aligns with the best interests of the company and our shareholders.

The nominees have consented to being named in this Proxy Statement and to serve if elected. The Board has no reason to believe that any nominee will be unavailable or unable to serve as a director, but if for any reason any nominee should not be available or able to serve, the shares represented by all valid proxies will be voted by the person or persons acting under said proxy in accordance with the recommendation of the Board.

The Board consists of seven directors, all of whom are independent with the exception of our Chairman and CEO and K. Don Cornwell. The Board is classified into three classes, designated Class I, Class II and Class III. The term of office of the members of one class of directors expires each year in rotation so that the members of one class generally are elected at each annual meeting to serve for full three-year terms or until their successors are elected, or until such director’s death, resignation or retirement. Each class consists, as nearly as possible, of one-third of the total number of directors constituting the entire Board.

The Board is comprised of actively engaged individuals with diverse skills, experiences and backgrounds that contribute to the effective oversight of our company. The Board believes these varied qualifications help to inform and oversee decisions regarding the company’s long-term strategic growth. Under the guidance of the Nominating/Corporate Governance Committee, the Board reviews the structure of the Board, its committees and the individual directors and, as part of that process, considers, among other things, issues of structure, leadership and oversight needs and skills to guide the company in executing its long-term strategic objectives.

6

Corporate Governance

| | |  |

| | | James Costos | Age: 61 | Director since February 2017 |

| | Professional Highlights | ||

| | James Costos served as the United States Ambassador to the Kingdom of Spain and the Principality of Andorra from August 2013 to January 2017. Before his diplomatic service, he held leadership roles in the entertainment and international business sectors. Notably, Mr. Costos was Vice President at Home Box Office (HBO) from 2007 to 2013, and his executive experience also includes | ||

leadership positions at Revolution Studios, Tod’s S.p.A., and Hermès of Paris. Currently, Mr. Costos holds the position of President at Secuoya Studios, a global Spanish TV and film content production studio headquartered in Madrid. He is also involved in the global venture technology group at Dentons, where he serves as a Senior Managing Director. In addition to his professional endeavors, Mr. Costos is dedicated to cultural and humanitarian causes. He serves on the J. William Fulbright Foreign Scholarship Board and sits on the boards of the Hispanic Society of America and the Human Rights Campaign, the largest LGBTQ+ advocacy and political lobbying organization in the United States. Mr. Costos earned his Bachelor of Arts degree in Political Science from the University of Massachusetts. | |||

Skills & Qualifications | |||

Mr. Costos’ international government relations and policy experience, international marketing, operations, technology and executive leadership experience positions him well to serve on the Board. His strong international experience brings a geographically diverse perspective to the oversight of our multi-national business operations. | |||

| | | Grace R. Skaugen | Age: 70 | Director since July 2020 |

| | Professional Highlights | ||

| | Grace Reksten Skaugen, a Norwegian national, has extensive experience working with a broad array of European companies. She currently chairs Orrön Energy AB (member of the Compensation Committee) and is a board member of Investor AB (Chair of the Audit and Risk Committee). Ms. Skaugen is also a trustee of the International Institute for Strategic Studies (IISS) in London. | ||

In 2009, Ms. Skaugen co-founded the Norwegian Institute of Directors, where she still serves on its board. She previously served as a senior advisor to HSBC (2014-2019) and Deutsche Bank (2007-2014). She was deputy chair (2012-2015) of the Norwegian oil company Statoil (now Equinor) and served on its board (2002-2015). Ms. Skaugen served as deputy chair (2013-2020), board member (2012-2020) and chair of the Compensation Committee at Orkla ASA, was a board member and member of the Compensation and Sustainability Committees at Lundin Energy AB (2015-2022) and chaired Euronav NV (where she was a member of the Compensation Committee, Sustainability Committee and Corporate Governance and Nomination Committee) (2016-2023). She has previous investment banking experience, having worked at the Nordic bank SEB, where she advised companies within the energy, transportation and technology sectors. Ms. Skaugen started her career as a postdoctoral researcher at Columbia Radiation Laboratory in New York. She is a physicist by education and holds a PhD in laser physics from Imperial College in London. She also holds an M.B.A. from the Norwegian School of Management, BI. | |||

Skills & Qualifications | |||

Ms. Skaugen’s experience and expertise in the international financial services industry, as well as her extensive corporate governance and board experience, provide unique insights into our business and add industry-specific expertise and knowledge to the Board. Her strong international experience brings a geographically diverse perspective to the oversight of our multi-national business operations. | |||

7

Corporate Governance

| | |  |

| | | Kenneth C. Whitney | Audit Committee Chair | Age: 66 | Director since October 2015 |

| | Professional Highlights | ||

| | Kenneth C. Whitney has managed a private family investment office since April 2013, focused on start-up businesses and entertainment projects. Since his retirement from Blackstone in April 2013 until September 2015, he was also a Senior Advisor to Blackstone. Mr. Whitney was previously a Senior Managing | ||

Director and Head of Blackstone’s Investor Relations & Business Development Group from 1998 to April 2013. After joining Blackstone in 1988, Mr. Whitney focused his efforts on raising capital for Blackstone’s private investment funds and the establishment of Blackstone affiliates in the alternative investment area. Mr. Whitney began his career at Coopers & Lybrand in 1980, where he spent time in the firm’s accounting and audit areas as well as in the tax and mergers and acquisitions areas. Mr. Whitney is a Tony Award-winning producer, and currently sits on the Board of Trustees for The First Tee and the University of Delaware, where he received a B.S. in Accounting. | |||

Skills & Qualifications | |||

Mr. Whitney’s experience and expertise in the private equity and financial services industry, as well as his extensive financial, accounting, operations and management experience, provide unique insights into our business and add industry-specific expertise and knowledge to the Board. | |||

| | | Thomas M. Ryan | Lead Independent Director and Compensation Committee Chair | Age: 71 | Director since October 2015 |

| | Professional Highlights | ||

| | Thomas M. Ryan is the former Chairman and Chief Executive Officer of CVS Health Corporation, formerly known as CVS Caremark Corporation, a pharmacy healthcare provider (“CVS”). He served as Chairman of CVS from April 1999 to May 2011 and Chief Executive Officer of CVS from May 1998 to February 2011, | ||

and also served as President from May 1998 to May 2010. Mr. Ryan serves on the board of Five Below, Inc., and is an Operating Partner of Advent International. Mr. Ryan was a director of Yum! Brands, Inc. from 2002 to 2017, Reebok International Ltd. from 1998 to 2005, Bank of America Corporation from 2004 to 2010 and Vantiv, Inc. from 2012 to 2015. | |||

Skills & Qualifications | |||

Mr. Ryan’s role as Chairman and Chief Executive Officer of a global pharmacy healthcare business, his extensive operations and management experience, his expertise in finance and strategic planning, as well as his public company directorship and committee experience, positions him well to serve on the Board. | |||

8

Corporate Governance

| | |  |

| | | K. Don Cornwell | Age: 53 | Director since January 2023 |

| | Professional Highlights | ||

| | K. Don Cornwell is a Co-Founder and the Chief Executive Officer of Dynasty Equity, a global sports investment firm focused on acquiring minority interests in sports franchises and other related assets and rights. Prior to founding Dynasty Equity in 2022, Mr. Cornwell was a founding partner at PJT Partners, joining the company in 2015 following an 18-year career at Morgan Stanley. At Morgan | ||

Stanley, Mr. Cornwell was in the Mergers and Acquisitions Group and established a particularly focused area of expertise in media and entertainment, specifically in sports and gaming. Prior to leaving Morgan Stanley, he served as Head of Global Sports Investment Banking. Before he joined Morgan Stanley, Mr. Cornwell worked at McKinsey & Co. as a management consultant and in corporate development for the National Football League. He sits on the Board of Trustees of the Harlem Children’s Zone, an education and social services organization in Central Harlem; the East Harlem Tutorial Program, an after-school program for children in East Harlem; the Board of Directors of New York Cares, New York City’s largest volunteer organization; and the VFILES Foundation, an organization with the mission to increase business ownership for creators in underrepresented communities. Mr. Cornwell served on the Management Board of Stanford University’s Graduate School of Business until July 2022. He received an MBA from Stanford University’s Graduate School of Business and an AB in Government from Harvard College. | |||

Skills & Qualifications | |||

Mr. Cornwell’s extensive experience and expertise in investment banking and in the financial services industry, as well as his deep knowledge of PJT Partners’ business, operations and culture, and his understanding of the company’s clients, employees and other stakeholders, position him to contribute valuable acumen and insight to the Board. | |||

| | | Paul J. Taubman | Chairman and Chief Executive Officer | Age: 63 | Director since October 2015 |

| | Professional Highlights | ||

| | Paul J. Taubman has been our Chairman and CEO since 2015. Prior to founding PJT Partners, Mr. Taubman spent nearly 30 years at Morgan Stanley where he served in a series of increasingly senior positions, including as executive vice president and Co-President of Institutional Securities, with responsibility for all | ||

of the firm’s investment banking, capital markets, and sales and trading businesses. Mr. Taubman serves in a leadership role on numerous philanthropic efforts including Board President of New York Cares, New York City’s largest volunteer organization; Trustee and Vice Chairman of Cold Spring Harbor Laboratory; Board Member of the Partnership for New York City; Advisory Council member at the Stanford Graduate School of Business; National Advisory Board member of Youth, Inc.; and Trustee of the Foundation for Empowering Citizens with Autism. Mr. Taubman received a B.S. in Economics from the Wharton School of the University of Pennsylvania and an M.B.A. from Stanford University’s Graduate School of Business. | |||

Skills & Qualifications | |||

Mr. Taubman’s extensive experience gained from various senior leadership roles in investment banking and the financial services industry, as well as his many years of providing strategic advice to management teams and boards around the world, operating in a wide array of industries bring valuable knowledge and expertise to the Board. In addition, Mr. Taubman’s role as our Chief Executive Officer brings management perspective to Board deliberations and provides critical information about the status of our day-to-day operations. | |||

9

Corporate Governance

| | |  |

| | | Emily K. Rafferty | Nominating/Corporate Governance Committee Chair | Age: 75 | Director since October 2015 |

| | Professional Highlights | ||

| | Emily K. Rafferty is President Emerita of The Metropolitan Museum of Art. She was elected President of the Museum in 2005 and served in that role until her retirement in March 2015. She had been a member of the Museum’s staff since 1976 serving in various roles in development, membership and external affairs | ||

until becoming President and Chief Administrative Officer in 2005, overseeing some 2,300 full- and part-time employees and volunteers. Ms. Rafferty’s global experience in some 50 countries on behalf of the Museum included interactions and negotiations with many senior world leaders. She is a Vice Chair of the National September 11 Memorial & Museum, a Board member of Carnegie Hall, the Advisory Board of the Hospital for Special Surgery, the Global Asia Society and the Hispanic Society Museum and Library. She is also a member of the Advisory Council of the American University of Beirut and the Council on Foreign Relations. Ms. Rafferty is principal of Emily K. Rafferty & Associates, a consulting resource for non-profit institutions. Ms. Rafferty served as a Board member of the New York Federal Reserve Bank from 2011 to 2017 (Chair, 2012 to 2016) and Koç Holdings, Istanbul from 2018 to 2024, Senior Adviser for Heritage Protection and Conservation for UNESCO from 2015 to 2017 and was Chair of NYC & Company (the city’s tourism, marketing and partnering organization) from 2008 to 2020 and continues to serve as an ex-officio board member. She previously consulted for Russell Reynolds Associates in the firm’s non-profit sector and The Shed, a NYC performing arts center. | |||

Skills & Qualifications | |||

Ms. Rafferty’s breadth and depth of expertise and experience in human capital management, operations and senior executive leadership, her global expertise as well as her understanding of monetary policy and regulation of financial institutions, provide valuable knowledge and insight to the Board. | |||

10

Corporate Governance

| | |  |

All of our directors and nominees are highly accomplished and experienced professionals, with fundamental attributes of senior leadership including integrity, honesty, intellectual curiosity, good judgment, strong work ethic, strategic thinking, vision, commitment to mission, excellent communication and collaboration skills, and the ability and willingness to challenge management constructively when needed. In addition to these and other core attributes, our directors and nominees possess a variety of other skills and experience necessary to carry out the Board’s responsibilities. The presentation below is a high-level summary of those skills and experience found on the Board, with information provided by the directors and nominees:

Banking & Financial Services | | | Breadth and depth of experience in the company’s business and industry |

Executive Experience | | | Experience in senior management roles, including serving as a CEO or senior executive, within a complex organization |

Financial Reporting | | | Expertise in overseeing the presentation of financial results as well as internal controls |

Human Capital Management | | | Experience in management of human resources and employee compensation |

International Business | | | Broad leadership experience within global companies and understanding of international markets |

IT & Cybersecurity | | | Expertise or experience in information technology, including understanding the importance of maintaining the trust of our clients through the protection of their information |

Legal & Regulatory | | | Experience in legal and regulatory affairs, and regulated industries, including as part of a business and/or through positions with government and/or regulatory bodies |

Marketing & Media | | | Experience overseeing internal and external communications and engagement with stakeholders |

Public Company Experience | | | Previous or current service as a director of other publicly traded companies |

Risk Management | | | Experience overseeing complex risk management matters |

Strategic Planning | | | Experience driving the strategic direction and growth of an organization |

Corporate Sustainability | | | Expertise or experience in corporate sustainability matters |

11

Corporate Governance

| | |  |

Professional Skills | | | Cornwell | | | Costos | | | Rafferty | | | Ryan | | | Skaugen | | | Taubman | | | Whitney |

Banking & Financial Services | | |  | | |  | | |  | | |  | | |  | | |  | | |  |

Executive Experience | | |  | | |  | | |  | | |  | | | | |  | | |  | |

Financial Reporting | | | | |  | | |  | | |  | | |  | | |  | | |  | |

Human Capital Management | | |  | | |  | | |  | | |  | | |  | | |  | | |  |

International Business | | |  | | |  | | |  | | | | |  | | |  | | |  | |

IT & Cybersecurity | | | | |  | | | | |  | | |  | | |  | | | |||

Legal & Regulatory | | |  | | | | | | |  | | | | |  | | |  | |||

Marketing & Media | | |  | | |  | | |  | | |  | | | | |  | | |  | |

Public Company Experience | | | | |  | | |  | | |  | | |  | | |  | | | ||

Risk Management | | |  | | | | |  | | |  | | |  | | |  | | |  | |

Strategic Planning | | |  | | |  | | |  | | |  | | |  | | |  | | |  |

Corporate Sustainability | | | | |  | | |  | | |  | | |  | | |  | | |

12

Corporate Governance

| | |  |

Our Board is composed of highly accomplished, actively engaged individuals with diverse skills, experiences and backgrounds who share our commitment to excellence, collaboration and integrity. The Board believes that fostering an inclusive culture both at the Board level and throughout the company enables us to provide the best advice and insights to our clients and better serve our stakeholders. The Board is making deliberate progress in seeking and electing new directors who enhance its composition and collective skills. In addition to contributing a variety of valuable experience and expertise, the three directors most recently elected to our Board all increased the racial, gender or LGBTQ+ diversity of the Board. Consistent with our commitment to continuous improvement, our Board annually assesses its collective diversity, experience and expertise, to check that these characteristics continue to align with our evolving business strategy and with the Board’s role in overseeing the company’s achievement of its long-term objectives. The Board comprises an inclusive mix of backgrounds and perspectives and includes two female directors, one Black director and one LGBTQ+ director. A majority of the Board — 57% — are members of groups that are historically underrepresented on public company boards:

Below is more detailed information about the Board’s diversity, with information provided by the directors and nominees:

Background | | | Cornwell | | | Costos | | | Rafferty | | | Ryan | | | Skaugen | | | Taubman | | | Whitney |

Black or African American | | |  | | | | | | | | | | | | | ||||||

Gender | | | | | | | | | | | | | | | |||||||

Male | | |  | | |  | | | | |  | | | | |  | | |  | ||

Female | | | | | | |  | | | | |  | | | | | |||||

LGBTQ+ | | | | |  | | | | | | | | | | | ||||||

Age/Tenure | | | | | | | | | | | | | | | |||||||

Age | | | 53 | | | 61 | | | 75 | | | 71 | | | 70 | | | 63 | | | 66 |

Tenure | | | 1 | | | 7 | | | 9 | | | 9 | | | 4 | | | 9 | | | 9 |

Board Diversity at a Glance |

A majority of the Board — 57% — are members of groups that are historically underrepresented on public company boards. |

|

Additional Board Characteristics | |||

66 Average Age | | | 7 years Average Tenure |

13

Corporate Governance

| | |  |

The Board is committed to corporate governance that serves the best interests of our company and shareholders, and to active engagement with our shareholders throughout the year. The following summarizes certain highlights of the Board’s guiding principles, corporate governance practices and policies:

Breadth of Skills and Expertise | | | From the inception of our company, we have sought to ensure that each of our directors embodied a level of experience and expertise that was outsized relative to an early-stage company to ensure immediate and effective implementation of our company’s long-term strategic goals and to provide oversight of our company’s risk profile and strategic goals. The Board is committed to the ongoing evaluation of its composition, including the skills and expertise of each director as well as the diversity of our directors and how their collective skills align with our evolving business strategy. |

Commitment to Diversity | | | The Board believes that fostering an inclusive culture — which welcomes differing perspectives, backgrounds and beliefs — enables us to provide the best-in-class advice to our clients. Accordingly, we aim to hire, develop and retain the best-in-class talent across all levels of the company, including the Board itself. |

Independent & Engaged Board | | | Five of our seven current directors (71%) are independent, with all Board committees comprised entirely of independent directors. The Board is actively engaged, holding four Board meetings and 12 Board committee meetings in 2023, as well as taking action through unanimous written consent. Directors actively engage and spend time with our senior management and other employees in a variety of forums outside of the board room. Our directors periodically attend partner meetings and dinners, participate in our town hall meetings, and meet with groups and individuals at our company. |

Focused Directors | | | Because serving on the Board requires significant time and attention, the Board has adopted a policy within its Corporate Governance Guidelines that, among other requirements applicable to the Board, set the expectation that directors will spend the time needed and meet as often as necessary to discharge their responsibilities properly. The Corporate Governance Guidelines also set expectations for the maximum number of public company boards a director may serve on and the maximum number of public company audit committees an Audit Committee member may serve on and provide for a Board review process and public disclosure requirements relating to these expectations. See “Corporate Governance Guidelines” below. |

Strong Lead Independent Director | | | The Board’s Lead Independent Director facilitates independent oversight of management. Our Lead Independent Director is responsible for coordinating the efforts of the non-management directors to ensure that objective judgment is brought to bear on important issues involving the management of the company, including the performance of senior management. See “Board Leadership Structure — Lead Independent Director” below. |

Shareholder Engagement and Responsiveness | | | As part of our annual shareholder engagement program, we contact many of our largest shareholders to offer meetings to discuss a range of topics related to the company’s strategy, governance profile, executive compensation practices, corporate sustainability, human capital management, financial performance and other matters. A thematic summary of recent investor conversations is included under the section “Shareholder Engagement and Responsiveness” below. |

14

Corporate Governance

| | |  |

Annual Evaluations | | | The Board conducts a self-evaluation annually to determine whether it, its committees and its individual members are functioning effectively and whether the Board possesses the appropriate expertise and diversity. Each committee of the Board also conducts a self-evaluation annually and reports the results to the Board. The Board, acting through the Nominating/ Corporate Governance Committee, monitors the mix of specific experience, qualifications, skills and diversity of its current directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the company’s business and structure. |

Open Channels of Communication Between the Board and Our Company | | | The Board maintains open channels of communication across our company. Our directors engage and spend time with our partners and employees throughout the year in a variety of forums. |

Minimum Equity Ownership Guidelines | | | We have minimum equity ownership guidelines for our directors that require significant ownership of our common stock. Our directors are required to hold equity in our company with a market value equal to or greater than three times their annual retainer. All of our directors are or are expected to be within the time ascribed in our ownership guidelines, in compliance with our Minimum Equity Ownership Guidelines. |

The Board understands there is no single, generally accepted approach to providing board leadership and that given the dynamic and competitive environment in which we operate, the appropriate leadership may vary as circumstances warrant. Our Restated Certificate of Incorporation provides that Mr. Taubman, to the extent that he serves as our CEO and as a member of the Board, will serve as Chairman of the Board. Further, the Board currently believes it is in our company’s best interests to have Mr. Taubman serve as Chairman of the Board as well as our CEO. The Board believes combining these roles promotes effective leadership and provides the clear focus needed to execute our business strategy and objectives.

Another important part of the Board’s leadership structure is the robust role of the Lead Independent Director. The Board has appointed Mr. Ryan as its Lead Independent Director and in this role, Mr. Ryan helps coordinate the efforts of the non-management directors to ensure that objective judgment is brought to bear on important issues involving the management of the company, including the performance of senior management. The authority and responsibility of our Lead Independent Director role is summarized in the following presentation:

15

Corporate Governance

| | |  |

The Board has three standing committees: an Audit Committee; a Compensation Committee; and a Nominating/Corporate Governance Committee. The current charters for these committees are available on our corporate website, at www.pjtpartners.com, under the “Investor Relations/Governance/Governance Documents” section. Further, we will provide copies of these charters without charge to any shareholder upon written request. Requests for copies should be addressed to our Corporate Secretary. The Board also may create additional committees for such purposes as the Board may determine.

| | | Audit Committee | | | Compensation Committee | | | Nominating/Corporate Governance Committee | |

K. Don Cornwell (Non-Independent) | | | | | | | |||

James Costos (Independent) | | |  | | | | |  | |

Emily K. Rafferty (Independent) | | | | |  | | |  | |

Thomas M. Ryan (Independent) | | | | |  | | |  | |

Grace R. Skaugen (Independent) | | |  | | | | | ||

Paul J. Taubman (Chairman & CEO) | | | | | | | |||

Kenneth C. Whitney (Independent) | | |  | | | | |

Committee Member Committee Member | | |  Committee Chair Committee Chair | | |

Our Audit Committee consists of Mr. Whitney (Chair), Mr. Costos and Ms. Skaugen, each of whom is “independent” and “financially literate” as such terms are defined by the applicable rules of the NYSE. The Board has determined that Mr. Whitney, Mr. Costos and Ms. Skaugen possess accounting or related financial management expertise within the meaning of the NYSE listing standards and that each of Mr. Whitney, Mr. Costos and Ms. Skaugen qualifies as an “audit committee financial expert” as defined under the applicable Securities and Exchange Commission (“SEC”) rules.

The Audit Committee assists the Board in fulfilling its responsibility relating to the oversight of:

> | the quality and integrity of our financial statements; |

> | our compliance with legal and regulatory requirements; |

> | our independent registered public accounting firm’s qualifications and independence; and |

> | the performance of our internal audit function and independent registered public accounting firm. |

Additional information regarding the functions performed by our Audit Committee is set forth in the “Report of the Audit Committee” included in this Proxy Statement.

Our Compensation Committee consists of Mr. Ryan (Chair) and Ms. Rafferty, each of whom is “independent” as defined by the applicable rules of the NYSE and is a “non-employee director” as defined by the applicable rules and regulations of the SEC. The Compensation Committee discharges the responsibilities of the Board relating to the oversight of our compensation programs and compensation of our executives, including oversight of the company’s human capital management and the administration of our clawback policy.

The Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, the Compensation Committee has retained Willis Towers Watson & Co. (“Willis Towers Watson”) as its independent outside compensation consultant primarily to assist in analyzing the competitiveness of the company’s

17

Corporate Governance

| | |  |

executive compensation as well as to provide expertise and advice on various matters brought before the Compensation Committee. On February 27, 2024, the Compensation Committee considered the independence of Willis Towers Watson and determined that its work did not raise any conflict of interest.

Our Nominating/Corporate Governance Committee consists of Ms. Rafferty (Chair), Mr. Costos and Mr. Ryan, each of whom is “independent” as such term is defined by the applicable rules of the NYSE. The Nominating/Corporate Governance Committee assists the Board in fulfilling its responsibility relating to corporate governance by:

> | identifying individuals qualified to become directors and recommending that the Board select the candidates for all directorships to be filled by the Board or by the shareholders; |

> | recommending directors to serve on committees and evaluating the operation and performance of the committees; |

> | developing and recommending to the Board the content of our Corporate Governance Guidelines and Code of Business Conduct and Ethics; |

> | overseeing the company’s environmental, social and governance strategy; and |

> | otherwise taking a leadership role in shaping our corporate governance. |

The Board monitors the mix of specific experience, qualifications and skills of its directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the company’s business and structure. While the Board does not have a formal diversity policy, the Board believes that fostering an inclusive culture, which welcomes differing perspectives, backgrounds and beliefs, enables us to provide the best-in-class advice to our clients.

The Nominating/Corporate Governance Committee is responsible for reviewing the qualifications of potential director candidates and recommending to the Board those candidates to be nominated for election to the Board. When considering director candidates, the Nominating/Corporate Governance Committee seeks individuals with backgrounds and qualities that, when combined with those of the company’s incumbent directors, provide a blend of skills and experience to further enhance the effectiveness of the Board. More specifically, the Nominating/Corporate Governance Committee considers:

Individual qualifications, including:

> | Relevant career experience |

> | Strength of character |

> | Mature judgment |

> | Familiarity with the company’s business and industry |

> | Independence of thought |

> | Ability to work collegially |

> | Corporate governance background |

> | Financial and accounting background |

> | Executive compensation background |

All other factors the Nominating/Corporate Governance Committee considers appropriate, including:

> | Size, composition and combined expertise of the existing Board |

> | Board diversity |

> | Existing commitments to other businesses |

> | Potential conflicts of interest with other pursuits |

> | Legal considerations |

When vacancies on the Board exist or are expected, or a need for a particular expertise has been identified, the Nominating/Corporate Governance Committee may seek recommendations for director candidates from current directors and management and may also engage a search firm to assist in identifying director candidates.

18

Corporate Governance

| | |  |

The Nominating/Corporate Governance Committee will also consider properly submitted shareholder recommendations for director candidates under the same procedure used for considering director candidates recommended by current directors and management. Shareholder recommendations for director candidates should include the candidate’s name and specific qualifications to serve on the Board, and the recommending shareholder should also submit evidence of such shareholder’s ownership of shares of our common stock, including the number of shares owned and the length of time of such ownership. Recommendations should be addressed to the Corporate Secretary. In addition, any shareholder who wishes to submit director nominations must satisfy the notification, timeliness, consent and information requirements set forth in our Amended and Restated By-Laws. See “Shareholder Proposals and Nominations for our 2025 Annual Meeting” below.

Our risk management framework is designed to instill a culture of openness and transparency. We have a complementary array of policies, procedures and processes to identify, assess, monitor and manage the risks inherent in our business activities, supported by the work of committees at both the management level and the Board level. This framework is reasonably designed to identify important risks and communicate them to senior management and, where appropriate, to the Board.

The Board understands the importance of effective risk oversight as fundamental to both the success of our company and its obligation to our shareholders. While our management is responsible for the day-to-day management of risk, the Board, along with senior management, is responsible for promoting an appropriate culture of risk management within the company and for overseeing our aggregate risk profile and monitoring how we address specific risks. Throughout the year, the Board and each of its committees dedicate a portion of their time to review and discuss specific risk topics.

The company’s management team regularly reports to the Board the significant risks we face, highlighting any new risks that may have arisen since they last met. In addition, our directors have the opportunity to meet routinely with members of senior management in connection with their consideration of matters submitted for the approval of the Board and the risks associated with such matters. On a periodic basis, members of senior management report on our top enterprise risks and the steps management has taken or will take to mitigate these risks. For example:

> | The Board meets at least twice annually with our Chief Technology Officer and/or external cybersecurity experts to assess cybersecurity risks and to evaluate the status of our cybersecurity efforts, which include a broad range of tools and training initiatives that work together to protect the data and systems used in our business. The Board is aware of the threats presented by cybersecurity incidents and is committed to taking measures to help prevent and mitigate the effects of any such incidents. |

> | Our Chief Compliance Officer provides updates to the Board on regulatory and compliance matters, which includes an annual in-depth review. |

> | Our General Counsel updates the Board regularly on material legal and regulatory matters. |

> | Our Chief Human Resources Officer provides updates to the Board on Human Capital matters, including hiring investment, talent, reward strategy and diversity and inclusion. |

> | The senior leadership of our shareholder advisory business also presents periodically to the Board on key trends shaping the shareholder landscape across governance, executive compensation, activism-defense, strategic investor relations and ESG matters. |

The Board exercises its risk oversight responsibility both directly and through its standing committees. The committees assist the Board by addressing specific matters within their purview, as summarized in the following table. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the Board keeps itself regularly informed regarding such risks through management and committee reports and otherwise.

19

Corporate Governance

| | |  |

Key Risk Oversight Responsibilities of the Board’s Committees | ||||||

Audit Committee | | | Compensation Committee | | | Nominating/Corporate Governance Committee |

> Financial statements, accounting, and internal controls over financial reporting processes > Qualifications, performance, and independence of independent registered public accounting firm > Performance of internal audit > Assessment of major risks facing the company and management’s efforts to manage those risks | | | > Overall compensation philosophy > Corporate goals and objectives relevant to compensation of the CEO and other Executive Officers, including annual performance objectives. > Evaluation of the CEO’s performance and determination of the CEO’s compensation > Review of other Executive Officers’ compensation > Modification of any executive compensation program yielding payments not reasonably related to executive and corporate performance > Review of potential material adverse effects on the company arising from compensation programs and plans for all employees > The company’s human capital management strategy > Administration of our clawback policy | | | > Director and committee member selection > Evaluation of the Board, committees and management > Development of the company’s corporate governance principles > Evaluation of director independence and possible conflicts of interest > Composition and size of the Board and committees > The company’s environmental, social and governance strategy |

We are continually evolving our technology platform to respond to innovation, cyber threats and the ongoing growth of our business. Given the potential impact of a security breach on our business and reputation, we are committed to continued investment in our technology to ensure the security of our information.

Breaches of our systems could involve attacks that are intended to obtain unauthorized access to, or to destroy, sensitive or proprietary information, or to disable, degrade or sabotage our systems. These attempts may involve the introduction of computer viruses or malware/ransomware, phishing or email spoofing, or cyber-attacks of other means that originate from a broad array of sources, including third parties and/or nation-states. We take various measures to ensure the confidentiality, integrity, and availability of our systems, including implementation of security controls and regular training of our employees with respect to measures we can take to try to thwart cybersecurity attacks. Further, all of our employees are trained at least annually on our information security policies. Employees are subject to reviews if they miss the training or fail repeated phishing tests. The Board takes an active role in reviewing our cybersecurity program.

The full Board retains responsibility for the oversight of management’s role in assessing and managing cybersecurity risk. The company’s management team reports at least twice annually to the

20

Corporate Governance

| | |  |

Board on risks and issues, including to evaluate the status of our cybersecurity efforts. The Board also discusses cybersecurity issues with external experts. For further details regarding our cybersecurity risk management and processes, please refer to Part I, Item 1C in our latest Annual Report on Form 10-K filed with the SEC.

As a financial services company, our business is subject to extensive rules and regulations in the United States and around the globe. Adherence to these various rules and regulations is paramount to the reputation and success of our company. As such, all of our employees are required to participate in various mandatory regulatory and compliance training programs designed to educate our employees on the many laws, rules and regulations that impact our company as well as reinforce the gravity of adherence to such laws, rules and regulations. Such programs include, without limitation, regular compliance training sessions on the company’s Global Compliance Policies Manual and Written Supervisory Procedures, including training sessions on our Anti-Money Laundering/Know Your Customer rules and procedures. In addition, all employees receive training on PJT Partners’ Code of Business Conduct and Ethics and our policies and procedures for reporting wrongdoing (see “Whistleblower Program” below).

The Board has adopted Corporate Governance Guidelines that address the following key corporate governance subjects, among others: director qualification standards; director responsibilities; director access to management and, as necessary and appropriate, independent advisors; director compensation; director orientation; management succession; service on other public company boards; and an annual performance evaluation of the Board. In February 2024, the Nominating/Corporate Governance Committee and the Board reviewed the Corporate Governance Guidelines, and the Board approved and re-adopted them.

You are encouraged to visit our website www.pjtpartners.com, under the “Investor Relations/Governance/Governance Documents” section to view or to obtain copies of our Corporate Governance Guidelines. You may also obtain, free of charge, a copy of our Corporate Governance Guidelines by directing your request in writing to our Corporate Secretary.

The Board has adopted a Code of Business Conduct and Ethics for our directors, officers and employees that addresses these important topics, among others: conflicts of interest; corporate opportunities; confidentiality of information; fair dealing; protection and proper use of our assets; compliance with laws, rules and regulations (including insider trading laws); and encouraging the reporting of any illegal or unethical behavior. In November 2023, the Board reviewed the Code of Business Conduct and Ethics, and the Board approved and re-adopted it.

Any waiver of the Code of Business Conduct and Ethics for our directors or officers may be made only by the Board or one of its committees. We intend to disclose on our website any amendment to, or waiver of, any provision of the Code of Business Conduct and Ethics applicable to our directors and Executive Officers that would otherwise be required to be disclosed under the rules of the SEC or the NYSE.

You are encouraged to visit our website at www.pjtpartners.com to view or to obtain copies of our Code of Business Conduct and Ethics. You may also obtain, free of charge, a copy of our Code of Business Conduct and Ethics by directing your request in writing to our Corporate Secretary.

As required by our Corporate Governance Guidelines, management works with the Board to provide an orientation process for new directors. The orientation programs are designed to familiarize new directors with the company’s business, strategies and challenges and to assist new directors in developing and maintaining skills necessary or appropriate for the performance of their responsibilities. Each new director’s onboarding is individually tailored to the experience and needs of the new director.

21

Corporate Governance

| | |  |

As part of our annual shareholder engagement program, we contact many of our largest shareholders to offer meetings to discuss a range of topics related to the company’s strategy, governance profile, executive compensation practices, corporate sustainability, human capital management, financial performance and other matters. These meetings may include participation by our Managing Partner, Chief Financial Officer, Chief Human Resources Officer and other members of management. This engagement program complements our normal course investor dialogue that we have conducted since the beginning of our company, focused on our business, strategy and financial performance, and demonstrates our commitment to maintaining an open dialogue with all of our shareholders. Our management team shares investor feedback from this engagement program with our Board, and the Board values this constructive feedback, which prompts review of our governance, compensation and corporate sustainability practices. The Board remains committed to seeking out and responding to investor feedback.

In conversations throughout 2023, we discussed a range of topics, including:

> | Business Strategy and Priorities |

> | Board Composition and Diversity |

> | Board Structure and Governance Practices |

> | Executive Compensation |

> | Corporate Sustainability |

> | Human Capital Management and Culture |

From day one of our company, we have been committed to developing our culture as a commercial differentiator – one that attracts and retains people in order to create a world-class firm built for the long term. Our culture is defined by strong character, deep capabilities, broad domain expertise and a steadfast emphasis on collaboration. These qualities ensure we are best placed to provide unique commercial advice to our clients.

The success of our human capital philosophy is evidenced by the number and quality of hires we have made, our low levels of regretted attrition and the consistent positive feedback we receive through our employee surveys. Reinforcement of the culture we are building comes through engagement with our employees, the reward principles we apply to compensation and promotion decisions and our various talent development initiatives, which continue to evolve as we grow.

As of December 31, 2023, we employed 1,012 individuals globally, including 115 partners.

We believe our company culture is reinforced by rewarding employees who exemplify the pillars of our culture. Since the inception of our company, our compensation and promotion approach has been designed to reward employees based on their commercial contribution and commitment to our values. Our compensation is not formulaic and does not include individual revenue pay-outs. For a broad group of employees, discretionary bonuses also typically include a company stock component to reinforce long-term focus and alignment with the interests of our company and shareholders. All compensation and promotion decisions consider a number of factors aligned to the 4 core values of our culture:

> | Character - each individual is responsible for protecting our reputation, operating with the highest level of integrity and positively contributing to the development of our company culture; |

> | Collaboration - working together allows us to learn from each other, leverage relationships and provide the best solutions; |

22

Corporate Governance

| | |  |

> | Commercial impact/client relationships - how we partner and gain the trust of our internal and external clients correlates to the reputation we earn across markets; and |

> | Content - our employees have deep and differentiated domain expertise, enabling thought leadership and innovation. |

The Board actively oversees the human capital management strategy of the company. Some key examples of the Board’s engagement include:

> | The Board periodically discusses succession planning for our Named Executive Officers, including for our Chairman and CEO. The Board’s review includes an assessment of the experience, performance and skills of potential successors in these critically important roles. The Board holds CEO succession planning discussions in executive sessions led by the Lead Independent Director. |

> | The Board, including the Compensation Committee, maintains an active information flow with senior management and directs senior management to update and consult it regularly on key hires and other important aspects of the company’s human capital strategy. With the Board’s oversight, the company continuously refines human capital priorities based on business drivers, employee feedback and the overall environment for talent. |

> | Directors receive relevant employee communications, including announcements of transactions on which the company has advised. |

We view active dialogue with our employees as essential to maintaining our unique culture. Since 2017, we have conducted firmwide, anonymous surveys to formally solicit feedback from our employees regarding their on-the-job experiences, priorities and recommendations for improvement. Participation has been consistently high, with response rates averaging 76%. The recurring positive themes of these employee surveys include a strong belief in our commitment to doing the right thing for both our clients and our company, a belief that PJT Partners has a differentiated culture, a commitment to excellence and a strong sense of respect among colleagues.

We use these results, along with feedback gathered through other employee connectivity forums, to further inform our priorities. Company leadership also maintains an active dialogue with employees through global town hall meetings, which take place quarterly. In an effort to maximize engagement and respond to feedback from the 2023 employee survey, the format of these meetings has now been modified to include either a business or rank-specific update from senior management every other quarter.

We also maintain several other channels to engage with our employees on human capital topics, including our talent development committee, women’s development series, individual performance reviews and other less formal forums, such as regularly scheduled meetings within each business. We use these channels to discuss employee feedback and ideas relating to issues such as resourcing and training priorities. We continue to support our employee resource groups, including PJT Partners Women’s Network, PJT Pride and the PJT Black Professional Network, and challenge ourselves to be a more inclusive team and to create an atmosphere where all differences are celebrated.

We prioritize the health and well-being of our employees and their families. We have always aimed to provide pay, benefits and other support that seeks to meet the varying needs of our employees. Our total rewards package is based on competitive pay and is often structured to include discretionary bonuses that include long-term incentives. Such incentives are designed to ensure alignment with our shareholders and the overall success of our company. Other benefits we provide employees include comprehensive health care, 401(k) plan matching or pension contributions based on geographic practices, generous paid time off, discounted gym memberships, access to walk-in health care and emergency child and elderly care. We recognize that mental health is an integral part of our employees’ overall well-being and essential to our success at PJT Partners. In addition to providing workshops on mental health awareness, we expanded our employee benefits to include a

23

Corporate Governance

| | |  |

comprehensive mental health platform that provides on-demand access from a broad provider network. Furthermore, we acknowledge work-life balance issues for our employees through paid-time off and leave policies that are consistent for all, regardless of level.

It is our practice to review and benchmark not only our compensation practices, but our health and wellness benefits annually and consider feedback from our employees to ensure we remain an employer of choice. This review has resulted in numerous policy refinements since the start of our company.

Our success as a company is predicated on recruiting, developing and retaining top talent from a diverse range of backgrounds and experiences, fostering an inclusive culture and leveraging diversity of thought. To support these aims, we have implemented initiatives to raise awareness and embed DE&I within our talent strategy:

> | Performance objectives relating to an employee’s individual contributions to supporting a more inclusive culture are incorporated in firmwide reviews. |

> | We continue to support our employee resource groups, including PJT Partners Women’s Network, PJT Pride and the PJT Black Professional Network. |

A core measure of our success is our ability to make a difference in the communities where we live and work. Since 2020, the company and our employees have donated over $7.9 million to more than 350 global organizations that support causes and humanitarian efforts that are important to our communities, including COVID-19 relief, mental health, disease cure and prevention, strengthening communities, the advancement of racial equity and providing aid to those affected by war and natural disasters. Our employees also have the opportunity to participate in PJT fundraising events, and we have continued to require our summer program participants to complete a community volunteering project as a pre-requisite for a full-time offer.

The financial services industry is intensely competitive, and we expect it to remain so. Our competitors for talent include other investment banking and financial advisory firms as well as private equity firms, hedge funds and corporate entities. We compete on both a global and a regional basis, and on the basis of a number of factors, including the strength and depth of client relationships, industry knowledge, transaction execution skills, our range of products and services, innovation, reputation, our ability to offer a compelling career path and competitive rewards.

Our ability to continue to compete effectively in our business will depend upon our ability to attract new employees and retain and motivate our existing employees. As a result, we remain focused on ensuring that our employment proposition includes an attractive culture, development opportunities and competitive rewards.

Since the inception of our company, we have been committed to building a premier global advisory focused company based on a culture of excellence, integrity, and purpose, delivering best-in-class advice to decision makers around the globe. Our investment decisions have been guided by a relentless focus on building a company that will stand the test of time.

Our Corporate Sustainability Report is intended to share our ongoing efforts and progress on our corporate sustainability journey across several key aspects of our company, including our people, our business, our governance and how we give back to our communities. Based on the feedback we received from our shareholders, our report includes disclosures aligned with the Investment Banking & Brokerage SASB standard, part of the Value Reporting Foundation. Our 2023 report also includes our greenhouse gas (GHG) emissions data from 2020 - 2022, under the GHG protocol. Our 2023 Corporate Sustainability Report is available on the Investor Relations section of our website at http://www.pjtpartners.com.

24

Corporate Governance

| | |  |

A majority of the directors serving on the Board must be independent as required by the listing standards of the NYSE and the rules promulgated by the SEC. The company defines an “independent” director in accordance with the corporate governance rules of the NYSE. Under the NYSE’s corporate governance rules, no director qualifies as independent unless the Board affirmatively determines that the director has no “material relationship” with us, either directly or as a partner, shareholder or officer of an organization that has a relationship with us. Further, directors who have relationships covered by one of five bright-line independence tests established by the NYSE may not be found to be independent.

Audit Committee members are subject to heightened independence requirements under NYSE rules and Rule 10A-3 under the Exchange Act. NYSE rules require that in affirmatively determining the independence of any director who will serve on the Compensation Committee, the Board must consider all factors specifically relevant to determining whether a director has a relationship to the company that is material to that director’s ability to be independent from management in connection with the duties of a member of the Compensation Committee.

The Board has determined, based upon its review of all relevant facts and circumstances and after considering all applicable relationships of which the Board had knowledge between or among the directors and the company or our management, that each of our current directors and directors who served during 2023, other than Mr. Taubman and Mr. Cornwell, has no material relationship with us (either directly or as a partner, shareholder or officer of an organization that has a relationship with us) and is “independent” as defined in the NYSE listing standards, the applicable SEC rules and our director independence standards. Further, the Board has determined that the members of the Audit Committee and Compensation Committee are also independent under the applicable NYSE and SEC rules mentioned above. No director participated in the final determination of his or her own independence.