| Employee Diversity & Inclusion |

FN-IB-330a.1 |

Percentage of gender and racial/ethnic group representation for (1) executive management, (2) non-executive management, (3) professionals, and (4) all other employees |

- Executive Officers: 50% female

- Board of Directors: 57% diverse1,2and 29% female1

- US employees: 36% female and 32% racially diverse3

- US analysts and associates: 34% female and 42% racially diverse3

Please refer to the People section of this report on pages 8-18 for more information.

|

| Incorporation of ESG in Investment Banking & Brokerage Activities |

FN-IB-410a.1 |

Revenue from (1) underwriting, (2) advisory and (3) securitization transactions incorporating integration of environment, social and governance (ESG) factors, by industry |

Substantially all ofour revenues are derived from contracts with clients to provide advisory and placement services, as outlined on page 47 of our 2021 Form 10-K. While we do advise our clients across a broad range of ESG-related issues as outlined on page 21 of this report, we do not currently classify revenues according to ESG factors. |

| FN-IB-410a.2 |

(1) Number and (2) total value of investments and loans incorporating integration of environmental, social and governance (ESG) factors, by industry |

We do not currently make these transactions in the ordinary course of business. |

| FN-IB-410a.3 |

Description of approach to incorporation of environmental, social and governance (ESG) factors in investment banking and brokerage activities |

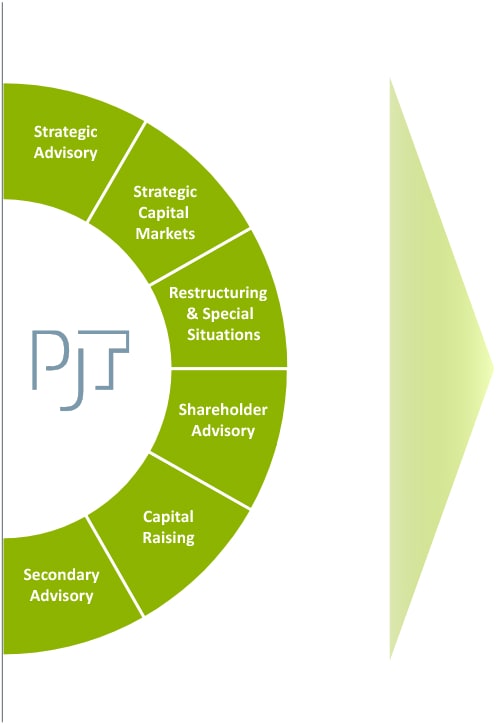

Today’s rapidly changing landscape related to climate change, social considerations, workforce issues, governmental policies and governance practices continues to raise the importance of ESG as a key factor in business decision making. At PJT Partners, we advise our clients across a broad range of ESG-related issues. We have built a cross-disciplinary ESG practice that leverages our collaborative team-based approach to respond to the breadth of potential ESG-related challenges and opportunities that our clients are facing. Please refer to page 21 of this report for further discussion on integration of ESG into our businesses. |

| Business Ethics |

FN-IB-510a.1 |

Total amount of monetary losses as a result of legal proceedings associated with fraud, insider trading, anti-trust, anti-competitive behavior, market manipulation, malpractice, or other related financial industry laws or regulations |

Material legal proceedings are disclosed in Item 3 of our 2021 Form 10-K and in Part II. Item 1. Legal Proceedings of our subsequently filed Quarterly Reports on Form 10-Q. |

| FN-IB-510a.2 |

Description of whistleblower policies and procedures |

Our whistleblower policies are designed to provide a channel of communication for employees and others who have concerns about the conduct of our company or any of its people, including with respect to the firm’s accounting controls or auditing matters. More detail on how to file a report can be found on pages 35-36 of our most recent proxy statement. Our whistleblower policyis included under the Governance section of our Investor Relations website. |

| Professional Integrity |

FN-IB-510b.1 |

(1) Number and (2) percentage of covered employees with a record of investment-related investigations, consumer-initiated complaints, private civil litigations, or other regulatory proceedings |

Material legal proceedings are disclosed in Item 3 of our 2021 Form 10-K and in Part II. Item 1. Legal Proceedings of our subsequently filed Quarterly Reports on Form 10-Q. |

| FN-IB-510b.2 |

Number of mediation and arbitration cases associated with professional integrity, including duty of care, by party |

Material legal proceedings are disclosed in Item 3 of our 2021 Form 10-K and in Part II. Item 1. Legal Proceedings of our subsequently filed Quarterly Reports on Form 10-Q. |

| FN-IB-510b.3 |

Total amount of monetary losses as a result of legal proceedings associated with professional integrity, including duty of care |

Material legal proceedings are disclosed in Item 3 of our 2021 Form 10-K and in Part II. Item 1. Legal Proceedings of our subsequently filed Quarterly Reports on Form 10-Q. |

| FN-IB-510b.4 |

Description of approach to ensuring professional integrity, including duty of care |

Integrity, honesty and sound judgment are fundamental to the reputation and success of our firm. We believe that professional integrity is emphasized in the “tone at the top” set by our Board and executive management and cascaded down throughout the firm. Such emphasis is memorialized in the firm’s Code of Business Conduct and Ethics and each partner and employee must annually certify their adherence to the policies and procedures set forth therein. We also provide ongoing training programs to further educate our employees regarding legal and regulatory requirements. Please refer to pages 25-28 of this report for further discussion on how we protect our franchise. |

| Systemic Risk Management |

FN-IB-550a.1 |

Global Systemically Important Bank (G-SIB) score, by category |

We arenot currently considered a G-SIB. |

| FN-IB-550a.2 |

Description of approach to incorporation of results of mandatory and voluntary stress tests into capital adequacy planning, long-term corporate strategy and other business activities |

We are not subject to mandatory firm-wide capital requirements or stress testing. Certain of our subsidiaries are subject to regulatory requirements, including the requirement to maintain certain levels of capital. Our finance team monitors capital adequacy for third party offerings for which we act as an underwriter and regulatory purposes in accordance with the relevant requirements of each jurisdiction. |

| Employee Incentives & Risk Taking |

FN-IB-550b.1 |

Percentage of total remuneration that is variable for Material Risk Takers (MRTs) |

For information on our compensation philosophy, please see“Compensation” on page 11 of our most recent proxy statementand “Compensation of our Executive Officers” on page 39 of our most recent proxy statement. |

| FN-IB-550b.2 |

Percentage of variable remuneration of Material Risk Takers (MRTs) to which malusor clawbackprovisions were applied |

We have a compensation clawbackpolicy for executive officers; however, noclawbackprovisions related to malus or professional integrity were applied in 2021. For information on our compensation philosophy, please see “Claw backPolicy”on page 48 of our most recent proxy statement. |

| FN-IB-550b.3 |

Discussion of policies around supervision, control and validation of traders’ pricing of Level 3 assets and liabilities |

We do not engage in trading activities and therefore we do not have traders who price Level 3 assets and liabilities. |

| Activity Metrics |

FN-IB-000.A |

(1) Number and (2) value of (a) underwriting, (b) advisory and (c) securitization transactions |

Substantially all ofour revenues are derived from contracts with clients to provide advisory and placement services.

The amount of full year 2021 advisory and placement revenues are disclosed on page 47 of our 2021 Form 10-K. |

| FN-IB-000.B |

(1) Number and (2) value of proprietary investments and loans by sector |

We do not currently make these transactions in the ordinary course of business. |

| FN-IB-000.C |

(1) Number and (2) value of market making transactions in (a) fixed income, (b) equity, (c) currency, (d) derivatives, and (e) commodity products |

We do not currently make these transactions in the ordinary course of business. |